আরও দেখুন

26.05.2025 06:33 PM

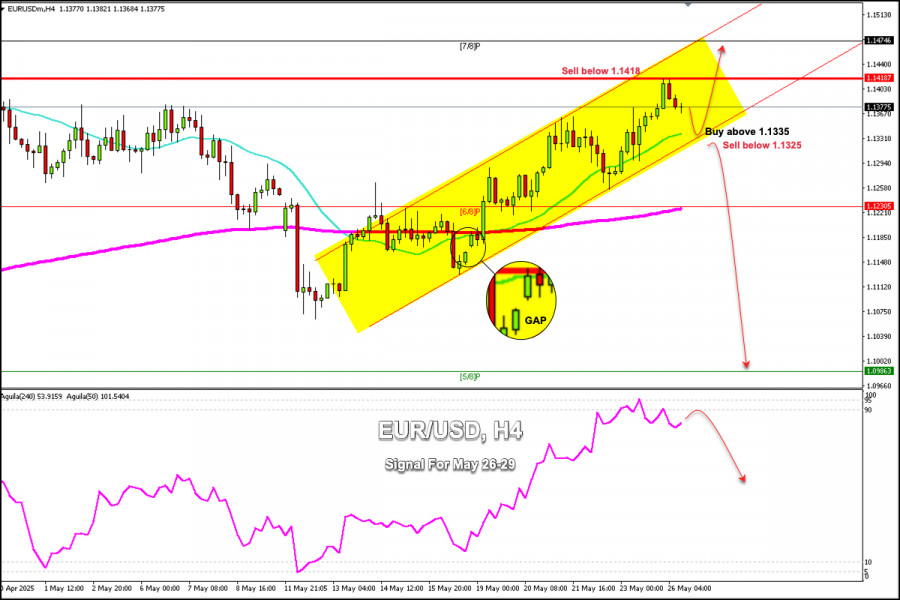

26.05.2025 06:33 PMEarly in the American session, the euro is trading around 1.1377, undergoing a technical correction after reaching a high of 1.1418 during the European session.

The euro reached price levels seen at the end of April, and we believe it could continue to fall in the coming hours, reaching the 21SMA at 1.1335.

On the H4 chart, we can see that the euro has formed an uptrend channel since May 11. It is likely that after a technical correction, EUR/USD could rebound around 1.1335, which will be seen as a buying opportunity with targets at the 7/8 Murray level at 1.1418.

A decisive break of the uptrend channel and consolidation below 1.1325 would trigger a fall in the euro. Hence, EUR/USD could reach the 200 EMA around the 6/8 Murray level at 1.1230.

The euro left a gap around 1.1148 on May 15. If the EUR/USD pair falls below 1.1230, it could close this gap and could even reach the psychological level of 1.1000.

The eagle indicator is reaching overbought levels, so we believe the euro could continue its fall in the coming hours. Therefore, we will look for opportunities to sell below 1.1418.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।