আরও দেখুন

07.08.2025 05:07 AM

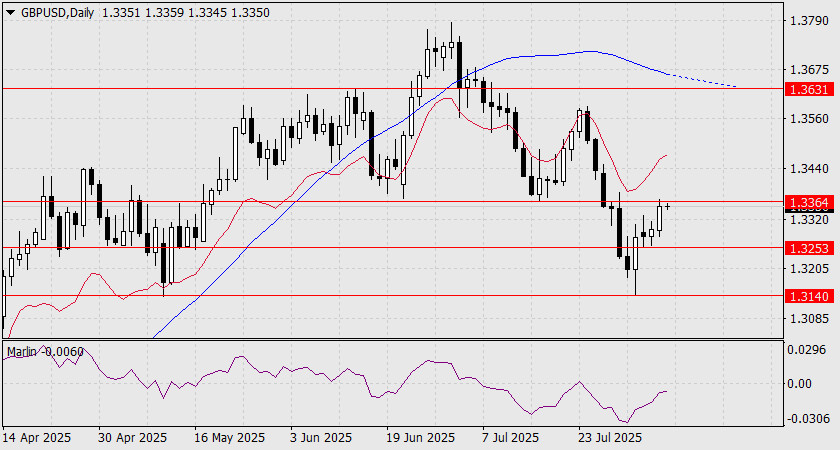

07.08.2025 05:07 AMBy the end of yesterday, the British pound rose by 56 pips, reaching the target level of 1.3364 – the upper boundary of the consolidation range between 1.3253 and 1.3364. Since the Marlin oscillator remains in negative territory, the price breakout above the upper boundary is being held back, making the preferred scenario a return to the lower boundary.

Today, the Bank of England is expected to cut the key rate from 4.25% to 4.00%. We previously noted that the market had not fully priced in such a cut, so the bearish scenario remains the base case. However, if the rate is kept unchanged, it could open the path for a rise toward 1.3631 (the June 13 high). The MACD line is approaching that level. The market's reaction to the BoE meeting remains to be seen.

On the four-hour chart, the price is consolidating below resistance at 1.3364. The Marlin oscillator is also showing signs of sideways movement within the range. However, this situation is likely to be short-lived — until the BoE announces its monetary policy decision.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।