আরও দেখুন

13.08.2025 05:00 AM

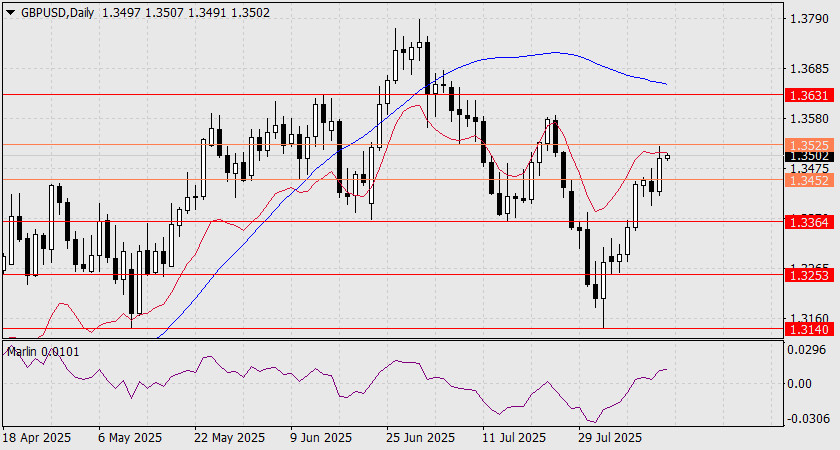

13.08.2025 05:00 AMYesterday, the British pound took full advantage of the temporary weakness in the dollar, reaching the second intermediate level of 1.3525. The Marlin oscillator is rising in the territory of an upward trend, and the price now only needs to consolidate above yesterday's level to open the way toward the target at 1.3631 (the June 13 high), or even slightly higher — toward the MACD line. However, the opposite scenario is also possible — a return below the 1.3452 level, opening the target at 1.3364.

It can be seen that the pound is currently within several ranges at the same time: 1.3452–1.3525, 1.3364–1.3452, and 1.3452–1.3631. This situation only reinforces a free-wheeling market behavior. The pound appears well-positioned for any medium-term scenario, but this also highlights its vulnerability to external market fluctuations. Therefore, we are waiting to see how events unfold.

On the four-hour chart, the Marlin oscillator does not share the optimism of the pound's latest upward wave. If the price consolidates below 1.3452, Marlin will also settle below the zero line. This would open the target support at 1.3364, which the MACD line is already approaching. Breaking this support would signal a medium-term decline in the pound. Consolidation above 1.3525 would allow the price to continue rising, albeit with increased risk.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।