আরও দেখুন

15.09.2025 07:39 PM

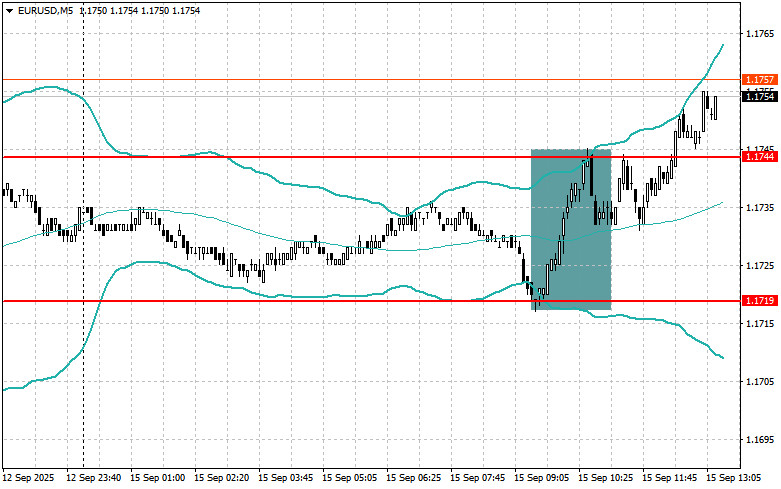

15.09.2025 07:39 PMThe euro was well executed today through the Mean Reversion strategy. Due to low market volatility, there was no opportunity to trade via Momentum.

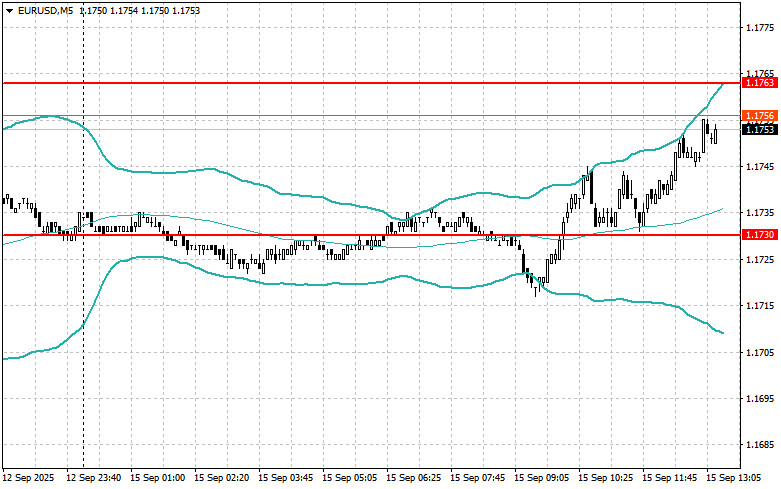

The decline in the eurozone trade balance surplus pressured the euro, but buyers took advantage of the moment to increase long positions. Overall, the U.S. dollar will continue to weaken against risk assets. It is clear that the dollar is under pressure from the relatively dovish policy expected from the Federal Reserve in the near future.

In the second half of the day, the Empire Manufacturing Index will be released, but it is unlikely to shift market sentiment in favor of the dollar. The market appears to have already priced in moderately negative data, given the broader picture of slowing U.S. economic activity. Moreover, traders are focused on global factors, such as the Fed's decision on interest rates. Geopolitical issues, including renewed U.S.–China trade tariff disputes, are also influencing the currency market. In the short term, the EUR/USD pair will likely continue its upward movement, driven by the fundamental strength of the European economy and the ECB's restrictive stance.

In the case of strong data, I will rely on implementing the Momentum strategy. If the market does not react to the release, I will continue using the Mean Reversion strategy.

Momentum Strategy (breakout) for the second half of the day:

For EUR/USD

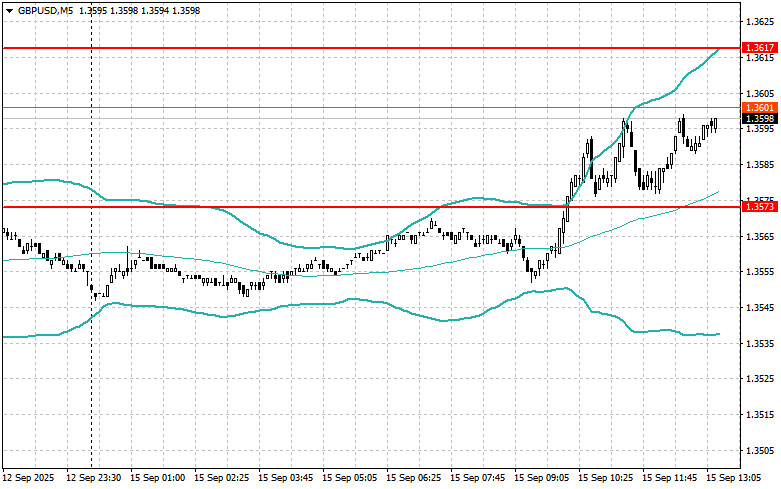

For GBP/USD

For USD/JPY

Mean Reversion Strategy (reversal) for the second half of the day:

For EUR/USD

For GBP/USD

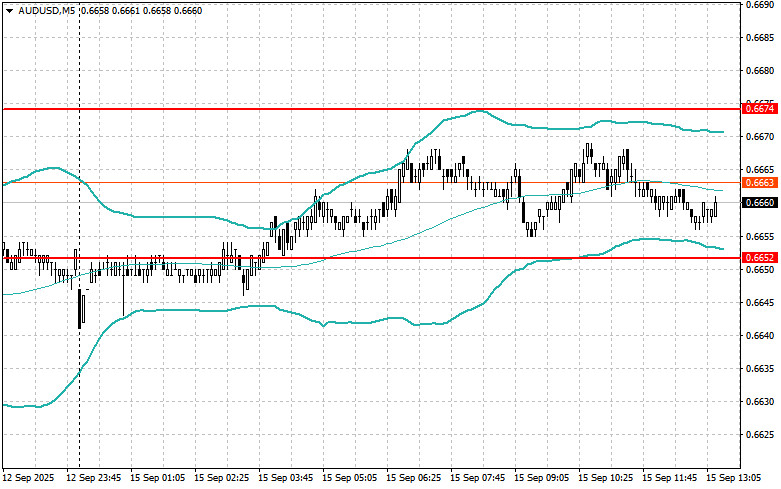

For AUD/USD

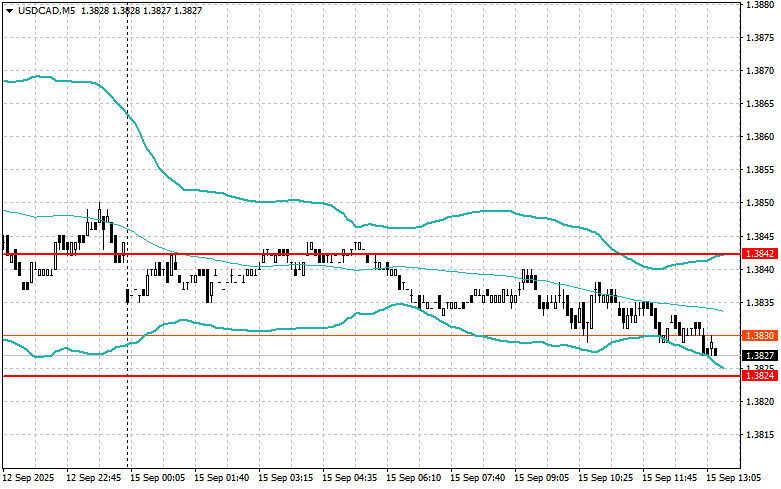

For USD/CAD

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।