আরও দেখুন

16.09.2025 05:34 AM

16.09.2025 05:34 AMGBP/USD

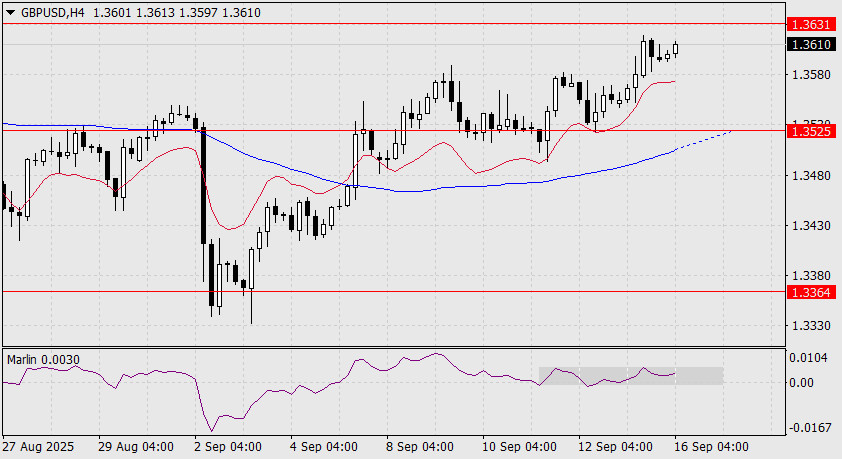

Sterling rose 40 pips yesterday against the backdrop of a 0.37% decline in the dollar index. However, this rise occurred on below-average volumes, which only underlines the risks of such a move in the absence of large players.

The target level of 1.3631 could be reached, but this would hardly change the signals of the Marlin oscillator, which is poised to reverse from the upper boundary of its own channel. A consolidation above 1.3631 would open the target at 1.3700 – the upper boundary of the global 18-year descending price channel. A reversal from this level is also expected.

A return below 1.3525, which would also correspond to moving under the MACD line, would open targets at 1.3364 and then 1.3253.

On the H4 chart, the price is aiming to test the target level of 1.3631, but Marlin is moving sideways. A pullback from the achieved level is expected. On this timeframe, the 1.3525 level is additionally supported by the MACD line from below. The 1.3525 mark is therefore key in determining whether the market chooses a downward direction. All eyes are on tomorrow's Fed meeting.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।