CZKJPY (Czech Koruna vs Japanese Yen). Exchange rate and online charts.

Currency converter

30 Jun 2025 07:41

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CZK/JPY is not very popular currency pair on the Forex market. The CZK/JPY does not include the U.S. dollar and that is why called a cross currency pair. However, the U.S. currency has a significant influence on it. This can be seen, if you combine two price charts: USD/JPY and USD/CZK. Thus, you will get an approximate CZK/JPY chart.

Since the U.S. dollar heavily influences both currencies, it is necessary to take into account the major U.S. economic indicators for the correct projection of this financial instrument’s price movement. You should pay attention to the U.S. discount rate, GDP data, unemployment rate, new jobs figures, etc. It is worth noting that the currencies comprising the pair can respond differently to changes in the U.S. economy; therefore, the CZK/JPY can be considered as a specific indicator of these currencies.

The Czech Republic has one of the most developed industrialized economies in Central Europe. The country is one of Europe’s most stable and prosperous nations. It is also characterized by high level of individual incomes due to its strong economic growth.

The key industries of the Czech economy include machinery, iron and steel production, chemical industry, electronics, the beer production, and agricultural sector. The automotive industry is one of the Czech Republic’s most important sectors. It is one of the world’s biggest export-oriented car manufacturers. Moreover, the Czech Republic is one of the leading exporters of beer and shoes. The large share of Czech total exports consists of a variety of chemical products: tires, synthetic fibers, etc. The main trade partners of the Czech Republic are Germany, Russia, Slovakia, and Austria. In addition, the country is one of the leading exporters of electricity in Europe, due to the wide range of possibilities for electricity generation in this country: nuclear, thermal, and hydro power plants; solar and wind power stations.

This trading instrument is considered to be illiquid as compared with the majors, such as: the EUR/USD, USD/CHF, GBP/USD and USD/JPY. Therefore, when you forecast the future trend of the currency pair, you need to pay attention to the major currency pairs that include the U.S. dollar.

The CZK/JPY currency pair is very responsive to a variety of major political and economic developments in the world. For this reason, the predictability power of its price chart is poor. Thus, it is a fairly common occurrence when the CZK/JPY price goes in the opposite direction to an analysis.

It is not recommended for beginners to start their currency trading with a given pair because successful CZK/JPY traders need to understand lot of subtleties and peculiarities of the price curve behaviour, which does not matter at first glance but can greatly affect the pair’s future exchange rate.

If you want to trade cross currency pairs, it is necessary to bear in mind that brokers’ spread is often higher for cross rates than for majors. Thus, you’d better read and understand the trading terms offered by the broker before you start your cross rate trading.

See Also

- Bitcoin made another attempt to return to the $108,000 level, but failed to hold it and corrected lower ...

Author: Miroslaw Bawulski

15:47 2025-06-27 UTC+2

3073

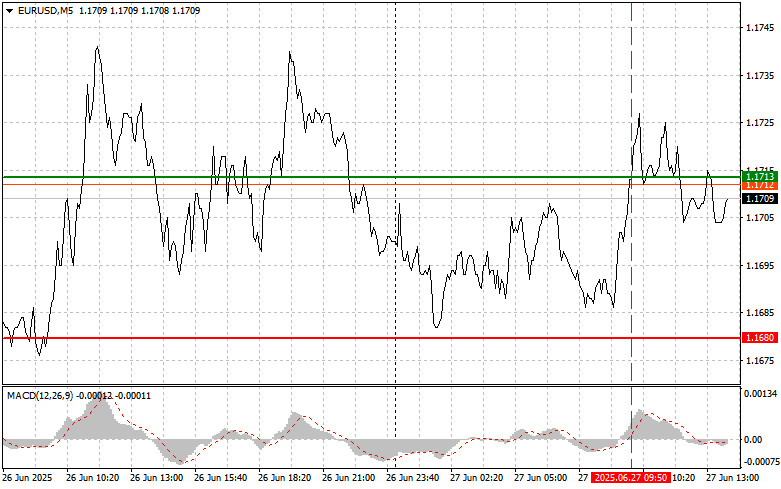

EUR/USD: Simple Trading Tips for Beginner Traders for June 27th (U.S. Session)Author: Jakub Novak

13:11 2025-06-27 UTC+2

3073

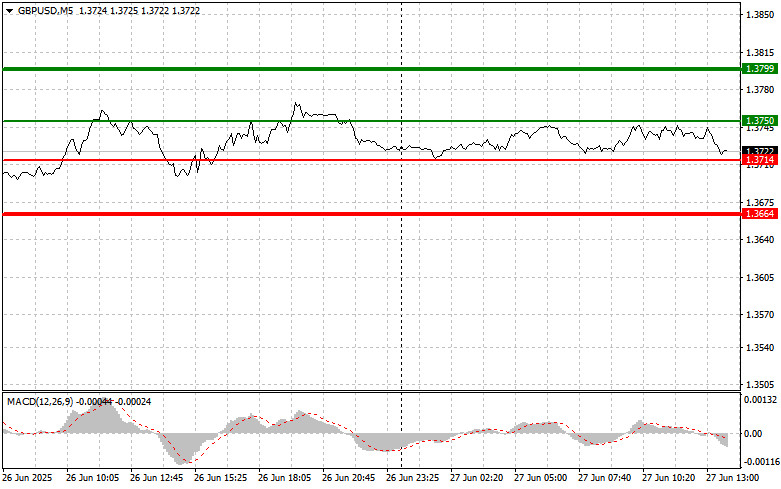

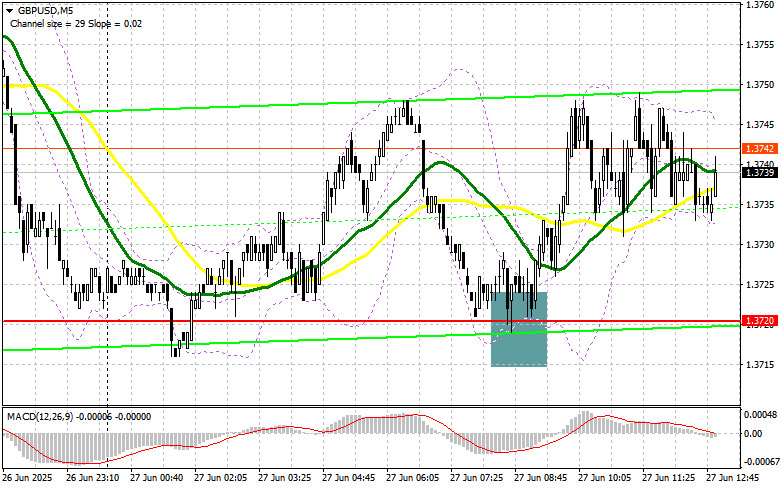

GBP/USD: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)Author: Jakub Novak

13:16 2025-06-27 UTC+2

2983

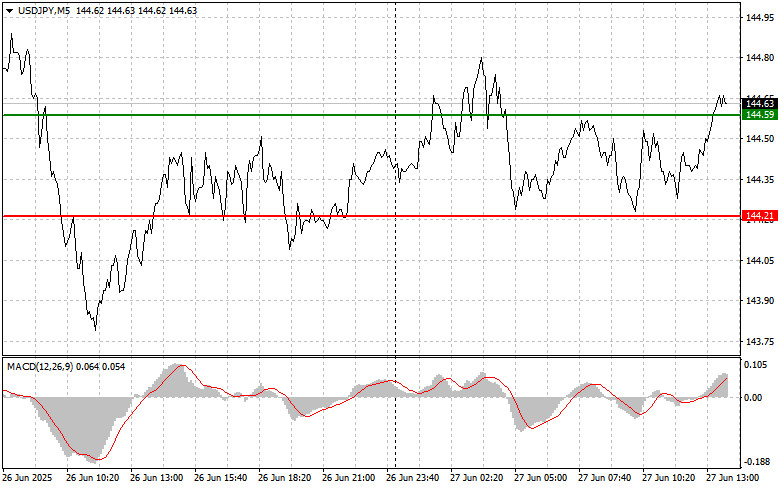

- USD/JPY: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:20 2025-06-27 UTC+2

2908

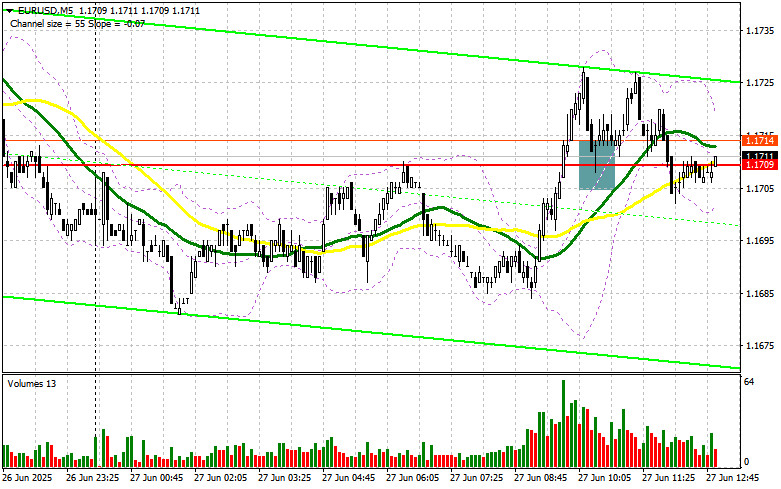

EUR/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)Author: Miroslaw Bawulski

13:01 2025-06-27 UTC+2

2848

GBP/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)Author: Miroslaw Bawulski

13:06 2025-06-27 UTC+2

2848

- Technical analysis

Trading Signals for GOLD (XAU/USD) for June 27-30, 2025: buy above $3,250 or sell below $3,320 (rebound - 6/8 Murray)

Technically, we believe that in the short term, gold could continue its fall and expect it to reach the 5/8 Murray level support around 3,203. The instrument might even cover the gap around 3,188 it created in May.Author: Dimitrios Zappas

18:12 2025-06-27 UTC+2

2563

Major US stock indices ended the week with solid gains. The Dow Jones and Nasdaq each rose by 1%, while the S&P 500 climbed by 0.8%. Broad investor participation points to renewed market interest following a period of uncertaintyAuthor: Ekaterina Kiseleva

12:56 2025-06-27 UTC+2

2473

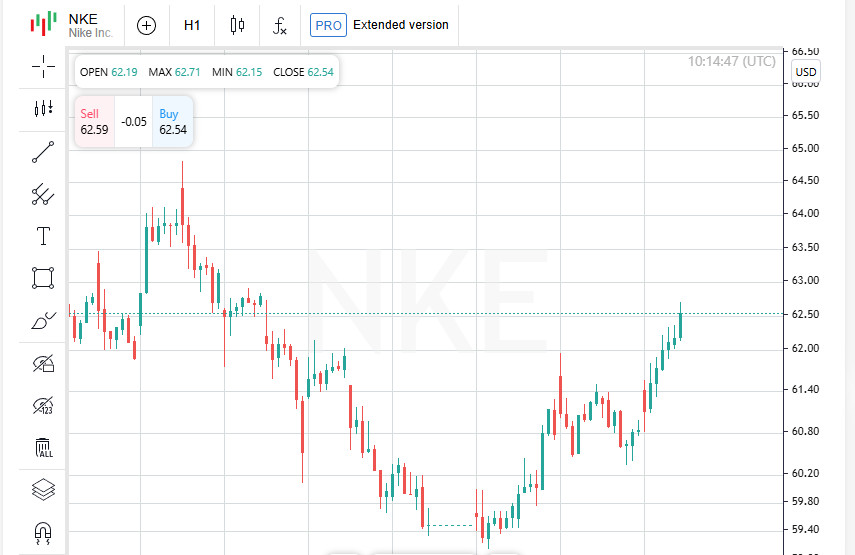

Indices rise: Dow 0.94%, S&P 500 0.80%, Nasdaq 0.97% Bank stocks rise as Fed proposes to ease leverage rules Nike results lift Adidas, Puma, JD Sports Knorr Bremse falls on Citi and JP Morgan ratings downgrades Indra rises after MS upgrade to 'overweight' Record copper prices send.Author: Thomas Frank

12:24 2025-06-27 UTC+2

2458

- Bitcoin made another attempt to return to the $108,000 level, but failed to hold it and corrected lower ...

Author: Miroslaw Bawulski

15:47 2025-06-27 UTC+2

3073

- EUR/USD: Simple Trading Tips for Beginner Traders for June 27th (U.S. Session)

Author: Jakub Novak

13:11 2025-06-27 UTC+2

3073

- GBP/USD: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:16 2025-06-27 UTC+2

2983

- USD/JPY: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:20 2025-06-27 UTC+2

2908

- EUR/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)

Author: Miroslaw Bawulski

13:01 2025-06-27 UTC+2

2848

- GBP/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)

Author: Miroslaw Bawulski

13:06 2025-06-27 UTC+2

2848

- Technical analysis

Trading Signals for GOLD (XAU/USD) for June 27-30, 2025: buy above $3,250 or sell below $3,320 (rebound - 6/8 Murray)

Technically, we believe that in the short term, gold could continue its fall and expect it to reach the 5/8 Murray level support around 3,203. The instrument might even cover the gap around 3,188 it created in May.Author: Dimitrios Zappas

18:12 2025-06-27 UTC+2

2563

- Major US stock indices ended the week with solid gains. The Dow Jones and Nasdaq each rose by 1%, while the S&P 500 climbed by 0.8%. Broad investor participation points to renewed market interest following a period of uncertainty

Author: Ekaterina Kiseleva

12:56 2025-06-27 UTC+2

2473

- Indices rise: Dow 0.94%, S&P 500 0.80%, Nasdaq 0.97% Bank stocks rise as Fed proposes to ease leverage rules Nike results lift Adidas, Puma, JD Sports Knorr Bremse falls on Citi and JP Morgan ratings downgrades Indra rises after MS upgrade to 'overweight' Record copper prices send.

Author: Thomas Frank

12:24 2025-06-27 UTC+2

2458