19.06.2025 10:50 AM

19.06.2025 10:50 AMEUR/USD

Analysis:

Short-term analysis of the euro's chart since February shows a dominant upward trend. In recent months, a corrective flat pattern has been forming, which remains incomplete. The price has reached the lower boundary of a strong potential reversal zone. The downward movement starting on June 12 holds reversal potential.

Forecast:

The week is expected to be flat for the euro. A reversal and a downward move are likely from the resistance zone by midweek. The projected support zone marks the probable end of the correction.

Potential Reversal Zones:

Recommendations:

USD/JPY

Analysis:

Since December last year, the main trend in USD/JPY has followed a downward wave. A counter-trend correction developed from early April. Since May 12, a reversal wave pattern has been forming. Over the past two weeks, the price has moved within a horizontal channel, forming a "horizontal pennant" pattern.

Forecast:

Early in the week, the current sideways trend is likely to continue, with gradual growth toward the resistance zone. Toward the weekend, increased volatility, a reversal, and resumed price decline are expected. The projected support may slow the weakening within the weekly range.

Potential Reversal Zones:

Recommendations:

GBP/JPY

Analysis:

The GBP/JPY pair continues its upward movement. Since mid-May, a counter-trend correction has been developing, resembling an "expanding flat" pattern. Recently, the price has moved along the lower boundary of the weekly support zone. The final segment of the wave is missing.

Forecast:

After a rise and potential test of the resistance zone early in the week, a reversal and downward movement toward projected support are expected. The highest volatility is likely closer to the weekend.

Potential Reversal Zones:

Recommendations:

USD/CAD

Analysis:

The daily timeframe for USD/CAD shows a downward wave since February. The structure currently appears complete. However, no clear reversal signals are present yet. The price remains within a strong higher timeframe potential reversal zone.

Forecast:

A test of the support zone is possible in the coming days, followed by a reversal and upward movement toward the resistance zone.

Potential Reversal Zones:

Recommendations:

NZD/USD

Brief Analysis:

Since April, NZD/USD has maintained an upward trend. The recent flat correction remains incomplete. The price moves near the upper boundary of a potential daily reversal zone.

Weekly Forecast:

The beginning of the week may see the end of the upward vector, transitioning into sideways movement within the resistance zone. Once reversal conditions are in place, a downward trend toward the projected support zone is expected.

Potential Reversal Zones:

Recommendations:

GOLD

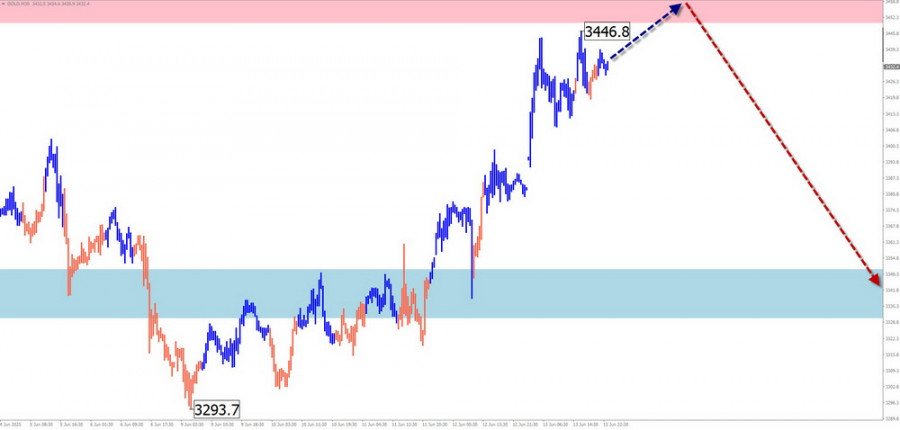

Analysis:

Since April 22, gold has been forming a downward wave, appearing as an "expanding flat" pattern. The price continues to move near the lower boundary of the weekly reversal zone. The final wave segment (C) of the correction is still missing.

Forecast:

Gold's current upward momentum may end within the coming days. There is a high probability of a test of the resistance zone, possibly with a brief breakout. A reversal and downward movement are more likely toward the weekend.

Potential Reversal Zones:

Recommendations:

Note: In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). Only the last, incomplete wave is analyzed on each timeframe. Dashed lines represent expected movements.

Caution: The wave algorithm does not account for the duration of market movements over time.

EUR/USD在4小時圖上的波浪結構已經持續數月未變,這令人非常振奮。即使出現調整波浪,結構的完整性仍被保持,這使得預測準確得以實現。

對於GBP/USD,波浪結構仍然顯示出看漲衝動波浪形態的形成。波浪圖幾乎與EUR/USD相同,因為唯一的「罪魁禍首」仍然是美元。

英鎊/美元的波浪形態繼續顯示上升動力波結構的形成。這種波浪圖幾乎與歐元/美元相同,因為唯一的「驅動因素」仍然是美元。

在4小時圖中,EUR/USD的波浪形態已經保持數月不變,這是個積極信號。即便在修正波形成過程中,結構的完整性仍然保留,使得預測更加準確。

歐元兌美元的四小時圖表中的波動模式已保持數月不變,這是一個非常積極的信號。即使在形成修正波時,結構的完整性也得以保持。

英鎊/美元的波浪形態繼續顯示出向上的衝擊波形態形成。該波浪圖幾乎與歐元/美元相同,因為唯一的“主要驅動因素”仍是美元。

在EUR/USD 4小時圖的波浪形態中,已經保持了數月不變,這是非常令人鼓舞的。即使在修正波形成時,整體結構依然保持完整。

目前,英鎊兌美元(GBP/USD)的波浪形態顯示出多頭衝動結構的發展跡象。這種波浪配置幾乎與歐元兌美元(EUR/USD)相同,因為這裡唯一真正的驅動因素是美元。

數月以來,EUR/USD工具的4小時圖的波浪模式一直保持不變,這是相當令人鼓舞的。即使在修正波形的形成過程中,其結構也保持穩定,允許進行準確的預測。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.