CHFDKK (Swiss Franc vs Danish Krone). Exchange rate and online charts.

Currency converter

03 Jul 2025 13:22

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CHF/DKK currency pair is not very popular on Forex market. This pair is the cross rate against the U.S. dollar. There is no U.S. dollar in this currency pair, but CHF/DKK is still under the great influence of it. To see this influence graphically, combine two charts (USD/CHF and USD/DKK) in the same price chart and you will get the approximate CHF/DKK chart.

The U.S. dollar exercises an enormous influence over the Swiss franc and the Danish krone. Therefore, for a better prediction of the future rate of this currency pair, you should consider the main economic indicators of the U.S.A. These indicators comprehend the interest rate, GDP, unemployment, new workplaces indicator and many others. The currencies listed above can react differently on changes in the U.S. economy.

The economy of Switzerland has been high for several centuries. So the Swiss franc is regarded as one of the most reliable and stable currencies in the world. Under the conditions of economic crisis the Swiss franc is the safest currency for capital investment. So when the capital is urgently going to Switzerland, the rate of the Swiss franc rises sharply against other currencies. While trading this financial instrument keep in mind this peculiarity of the Swiss economy.

Denmark is known as prosperous country with developed both industrial and agricultural sectors. Its economic indicators are one of the highest in the world. Despite its large oil reserves in Jutland and in the North Sea, Denmark faces the shortage of other minerals that makes it dependent upon their importing. This country has stable economic and trade relationships with all the developed countries in the world, especially with the EU countries. Denmark exports machinery, agricultural, mining products, electronics, etc.

For the reason that the economy of Denmark is one of the strongest in the world, its national currency is quite stable in pairs with other major currencies. The factors strengthening the Denmark economy are low inflation and unemployment rates, large oil and gas reserves (in the North Sea shelf and in Jutland), the high technology and highly qualified specialists in all economic fields.

However, there are still some factors that make the Denmark economy weaker. They include the high taxes and the deterioration of the competitiveness on the world market. Traders working with this financial instrument should take into account not only the Denmark economic indicators, but also the prices for oil and for other minerals needed for production in Denmark.

In comparison with major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY, this one is relatively illiquid. So when you forecast the future rate of this financial instrument, you should mainly concentrate your attention on the currency pairs that consists of the Swiss franc and the Danish krone in tandem with the U.S. dollar.

Remember that the spread for cross currency pairs is usually higher than for the more popular ones. Thus, before you start trading the cross rates, learn and understand the broker’s conditions for the specified trade instrument.

See Also

- Technical analysis / Video analytics

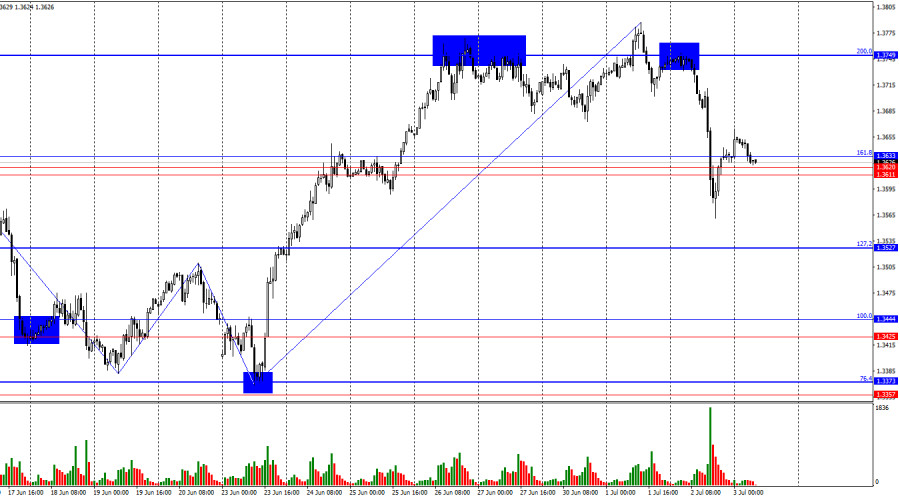

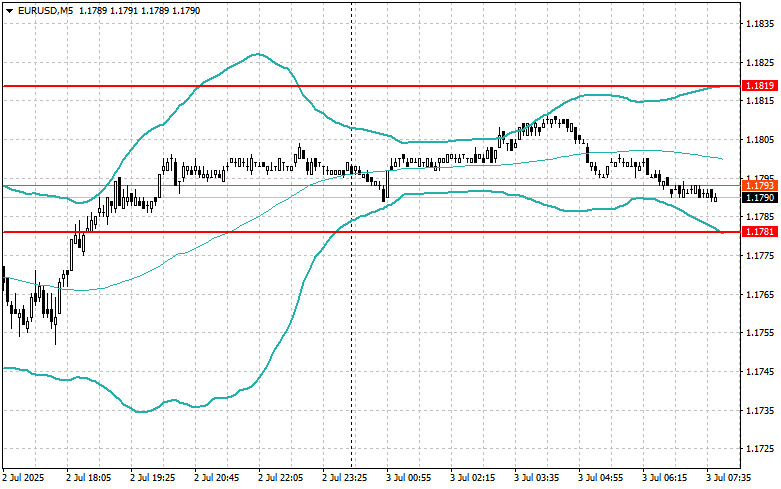

Forex forecast 03/07/2025: EUR/USD, USD/JPY, GBP/USD, SP500, Gold and Bitcoin

Technical analysis of EUR/USD, USD/JPY, GBP/USD, SP500, Gold and BitcoinAuthor: Sebastian Seliga

10:57 2025-07-03 UTC+2

2323

Technical analysisIf Crude Oil manages to break below the Pivot level, it has the potential to test its nearest Support level, Thursday, July 03, 2025.

Poor global economic conditions such as the stagnation ofAuthor: Arief Makmur

07:36 2025-07-03 UTC+2

793

Bears abruptly retreated from the market, but may launch a new offensive as early as todayAuthor: Samir Klishi

10:03 2025-07-03 UTC+2

748

- Technical analysis

The Nasdaq 100 index has the potential to test its closest Resistance level, Thursday, July 03, 2025.

Positive Big Tech Company financial reports and the increasinglyAuthor: Arief Makmur

07:36 2025-07-03 UTC+2

748

Nasdaq Closes 0.94%; S&P 500 Up 0.47%; Dow Down 0.02% Centene Falls After Cutting 2025 Outlook Tesla Rises, Rebounds From Early Week Losses Wall Street Futures Up 0.1%, Nikkei Flat Investors Await U.S. Tax Cuts, Spending BillAuthor: Thomas Frank

10:28 2025-07-03 UTC+2

733

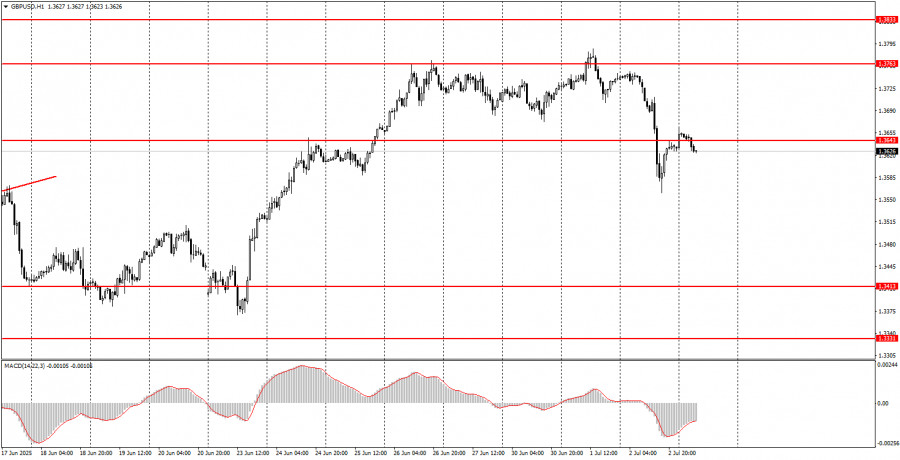

On Wednesday, the GBP/USD pair plunged like a stone dropped from a skyscraper, prompting currency analysts to immediately search for the reasons behind such a fallAuthor: Paolo Greco

06:53 2025-07-03 UTC+2

718

- Intraday Strategies for Beginner Traders on July 3

Author: Miroslaw Bawulski

07:25 2025-07-03 UTC+2

718

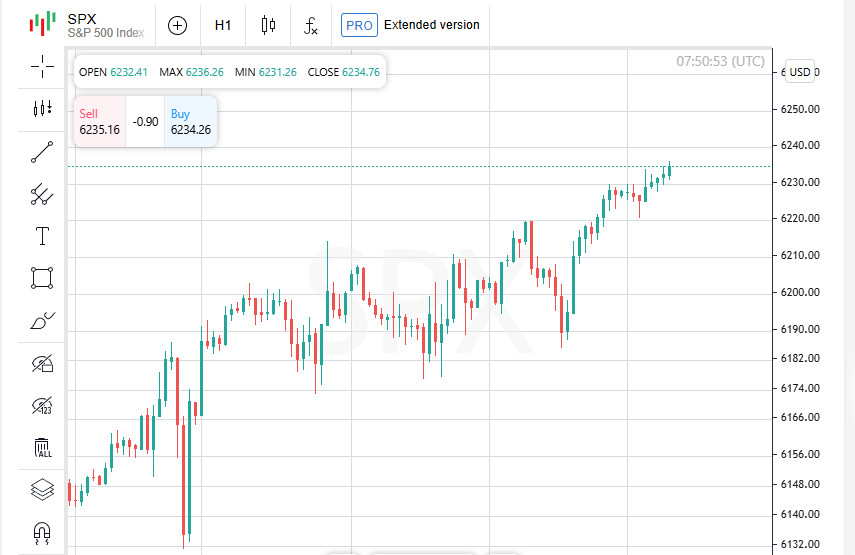

S&P 500 May Outperform European Peers in the Second Half of the YearAuthor: Marek Petkovich

09:35 2025-07-03 UTC+2

673

Trump Targets China Through VietnamAuthor: Jakub Novak

10:00 2025-07-03 UTC+2

658

- Technical analysis / Video analytics

Forex forecast 03/07/2025: EUR/USD, USD/JPY, GBP/USD, SP500, Gold and Bitcoin

Technical analysis of EUR/USD, USD/JPY, GBP/USD, SP500, Gold and BitcoinAuthor: Sebastian Seliga

10:57 2025-07-03 UTC+2

2323

- Technical analysis

If Crude Oil manages to break below the Pivot level, it has the potential to test its nearest Support level, Thursday, July 03, 2025.

Poor global economic conditions such as the stagnation ofAuthor: Arief Makmur

07:36 2025-07-03 UTC+2

793

- Bears abruptly retreated from the market, but may launch a new offensive as early as today

Author: Samir Klishi

10:03 2025-07-03 UTC+2

748

- Technical analysis

The Nasdaq 100 index has the potential to test its closest Resistance level, Thursday, July 03, 2025.

Positive Big Tech Company financial reports and the increasinglyAuthor: Arief Makmur

07:36 2025-07-03 UTC+2

748

- Nasdaq Closes 0.94%; S&P 500 Up 0.47%; Dow Down 0.02% Centene Falls After Cutting 2025 Outlook Tesla Rises, Rebounds From Early Week Losses Wall Street Futures Up 0.1%, Nikkei Flat Investors Await U.S. Tax Cuts, Spending Bill

Author: Thomas Frank

10:28 2025-07-03 UTC+2

733

- On Wednesday, the GBP/USD pair plunged like a stone dropped from a skyscraper, prompting currency analysts to immediately search for the reasons behind such a fall

Author: Paolo Greco

06:53 2025-07-03 UTC+2

718

- Intraday Strategies for Beginner Traders on July 3

Author: Miroslaw Bawulski

07:25 2025-07-03 UTC+2

718

- S&P 500 May Outperform European Peers in the Second Half of the Year

Author: Marek Petkovich

09:35 2025-07-03 UTC+2

673

- Trump Targets China Through Vietnam

Author: Jakub Novak

10:00 2025-07-03 UTC+2

658