See also

15.08.2025 02:52 PM

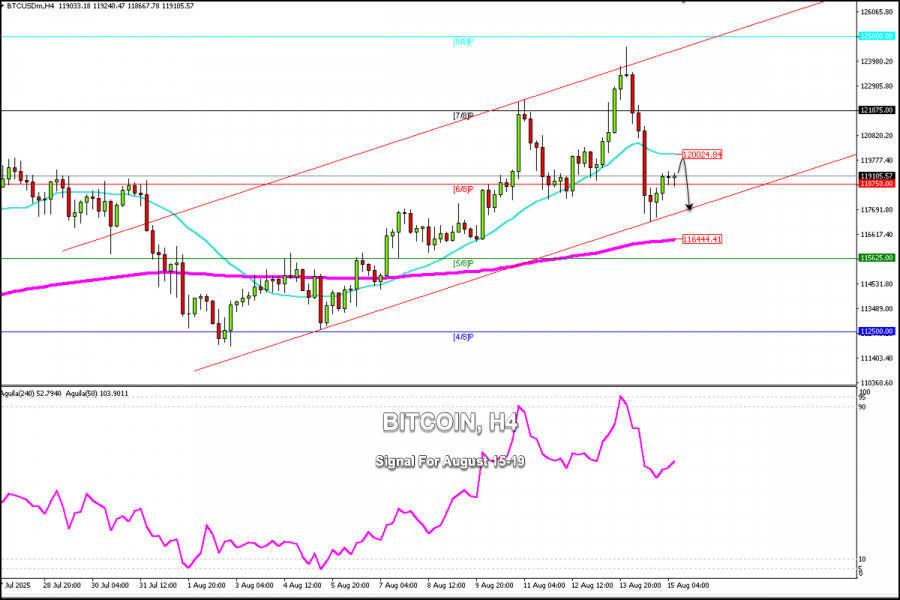

15.08.2025 02:52 PMBitcoin, after reaching its high of 124,500, made a strong technical correction in less than 24 hours, reaching $117,000.

A rapid correction of more than $7,000 from its peak price means that Bitcoin could continue its bearish cycle in the short term. The outlook is that we could expect BTC to reach $112,500.

If Bitcoin consolidates above the 6/8 Murray level at 118,750, which has now become key support, in the coming hours, we could expect it to reach $120,000, a level that coincides with the 21-SMA and could be seen as a signal to sell.

Conversely, a consolidation above the psychological level of $120,000 could see Bitcoin reach the 7/8 Murray level at 121,870 and even reach the 61.8% Fibonacci retracement level around $122,000.

Given that the pressure on Bitcoin is bearish, as long as the price trades below $120,000, we could sell with targets at $117,600. If this price is broken, we could even expect a sharp breakout of the uptrend channel, and Bitcoin could reach 5/8 of Murray at 115,625.

The eagle indicator reached the extremely overbought zone on August 13, which favored a strong technical correction. However, we now see the possibility of a Bitcoin recovery, which we should be vigilant about, as the bearish cycle could resume.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.