See also

02.05.2025 09:15 AM

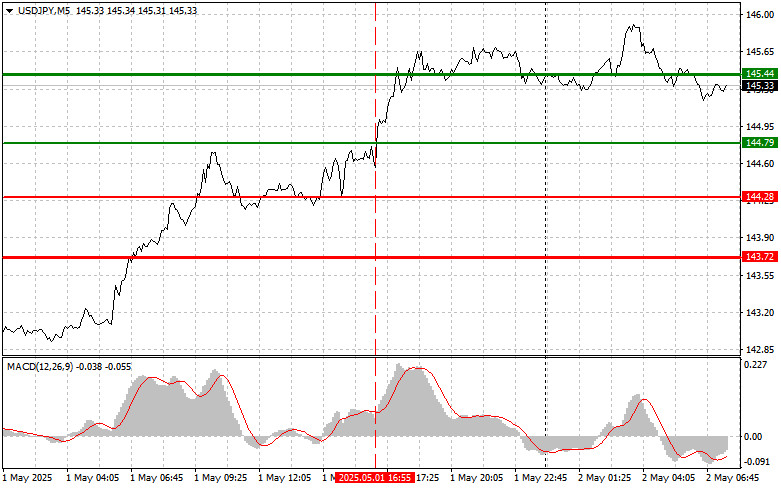

02.05.2025 09:15 AMThe test of the 144.79 level occurred at a time when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. Therefore, I did not buy the dollar and missed the entire move.

Today's news of a rise in Japan's unemployment rate triggered another sell-off in the yen against the dollar. Japan's monetary base data is also disappointing. Investors quickly dumped the yen, fearing further economic weakness and potential intervention by the Bank of Japan.

The market reacted instantly: USD/JPY jumped, breaking through key resistance levels. This reaction is likely tied to increasing concerns about Japan's economic outlook. Economists link the rise in unemployment to several factors, including an aging population, declining industrial competitiveness, and global economic uncertainty.

USD/JPY's next direction will be determined by upcoming U.S. labor market data, expected in the second half of the day. As a result, the European session may remain relatively quiet.

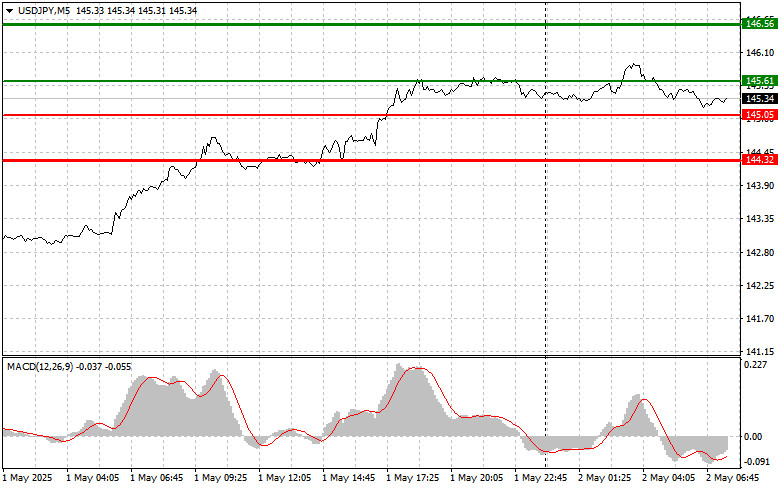

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point at 145.61 (green line on the chart), targeting a rise to 146.56 (thicker green line). Around 146.56, I plan to exit the long position and open a short position, expecting a 30–35 pip move in the opposite direction. The best entry points for buying this pair are during pullbacks or significant corrections.

Important: Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy USD/JPY if the 145.05 level is tested twice in a row while the MACD is in the oversold zone. This would limit the pair's downside potential and could trigger a bullish reversal. A rise toward 145.61 and 146.56 is expected.

Scenario #1: I will sell USD/JPY only after a confirmed break below 145.05 (red line), which could lead to a sharp decline. The primary target will be 144.32, where I plan to exit the short and open a long position, expecting a 20–25 pip bounce. Selling pressure is expected to reemerge only if U.S. economic data fails to meet expectations.

Important: Before selling, ensure the MACD indicator is below the zero line and beginning to fall.

Scenario #2: I also plan to sell USD/JPY if the 145.61 level is tested twice in a row while the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a bearish reversal. A drop toward 145.05 and 144.32 may follow.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 144.86 level occurred when the MACD indicator had just started to move upward from the zero line, confirming a valid entry point for buying the dollar

The test of the 1.3342 level in the second half of the day occurred when the MACD indicator had already significantly moved above the zero line, which limited the pair's

The price test at 1.1312 in the second half of the day coincided with the MACD indicator having already moved significantly above the zero line, which limited the pair's upward

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.