See also

07.05.2025 02:14 PM

07.05.2025 02:14 PMUS stock index futures surged sharply at the opening of today's trading session on news that representatives from the US and China have resumed consultations on trade matters. Media reports revealed an upcoming meeting between US Treasury Secretary Scott Bessent and Trade Representative Jamison Greer with Chinese officials on May 10–11 in Switzerland. This could mark the first step toward de-escalating the tariff war, giving market participants hope that the world's two largest economies may reach an agreement to ease tensions.

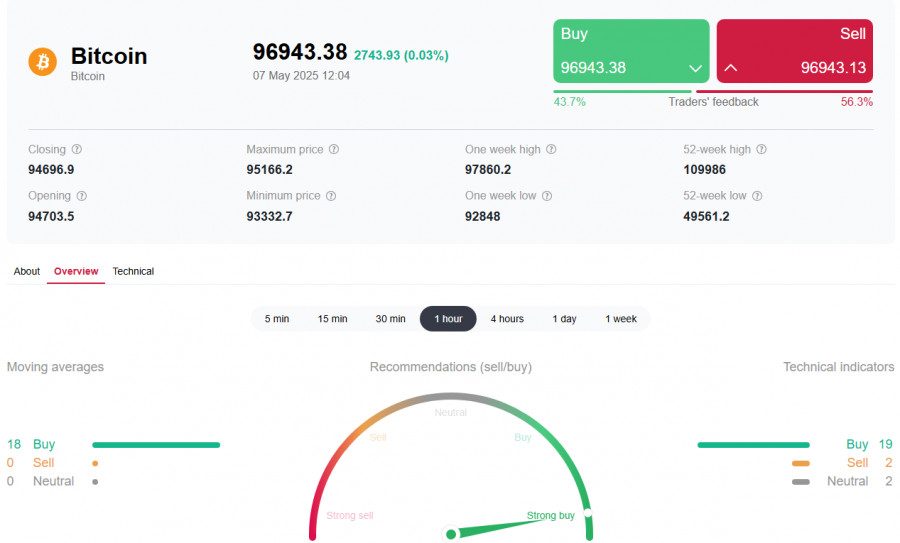

As risk assets, cryptocurrencies also opened the day with strong gains. Bitcoin rose 2.4%, trading near 96,800.00 in the BTC/USD pair at the time of writing.

Altcoins in the top 10 by market capitalization posted similar price changes, averaging around 2.5%. Cardano (ADA) was the strongest performer, up +2.4%. The total cryptocurrency market capitalization rose 1.7% over the past 24 hours to $2.99 trillion, according to CoinMarketCap.

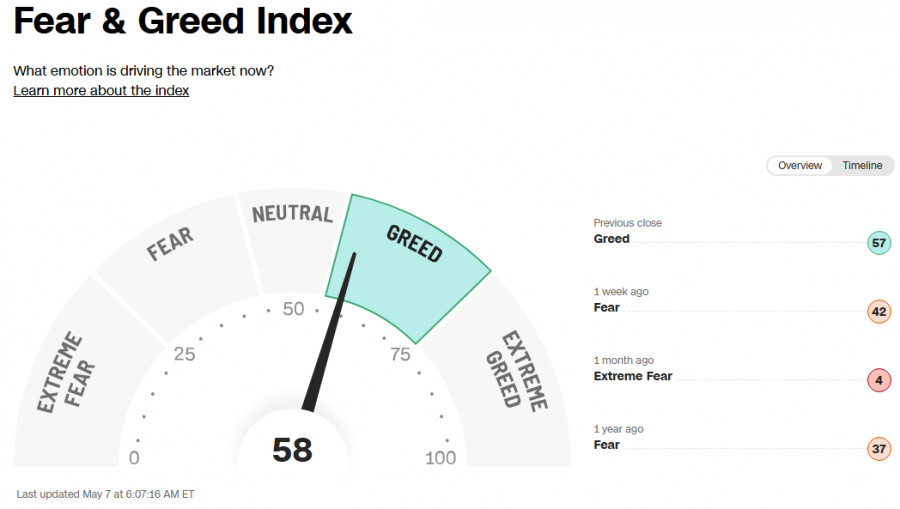

The Fear & Greed Index remains in the "greed" zone for the second day in a row, indicating increasing investor appetite for risk assets, including both stocks and cryptocurrencies.

However, economists caution against giving in to euphoria, recommending that traders stay calm and stick to their strategies.

Today marks the conclusion of the Fed's two-day meeting, which is unlikely to significantly impact the markets. The interest rate is widely expected to remain unchanged at 4.50%. At the same time, the Fed continues to resist pressure from the US President, who advocates for rate cuts.

If the Fed officials surprise the market with hawkish statements referencing inflation risks, the U.S. dollar may break resistance at the psychological level of 100.00 and continue its upward correction — a scenario we discussed in yesterday's report, "Dollar-Gold: PMI, Fed, Trump." In such a case, stock and crypto markets could face renewed selling pressure.

It's also worth noting that Matt Hougan, Chief Investment Officer at Bitwise, recently warned that the crypto industry may face a "rough summer" if the US Congress fails to pass at least one piece of cryptocurrency regulation. In his view, delayed legislation could undermine the momentum gained by crypto assets following Donald Trump's election as US President.

However, Hougan also believes that Bitcoin could reach $200,000 in 2025, provided legislative progress is made, particularly around the USD-backed stablecoin market, which Trump has been actively promoting since January, following his inauguration and the signing of his first executive order, "Strengthening US Leadership in Digital Finance."

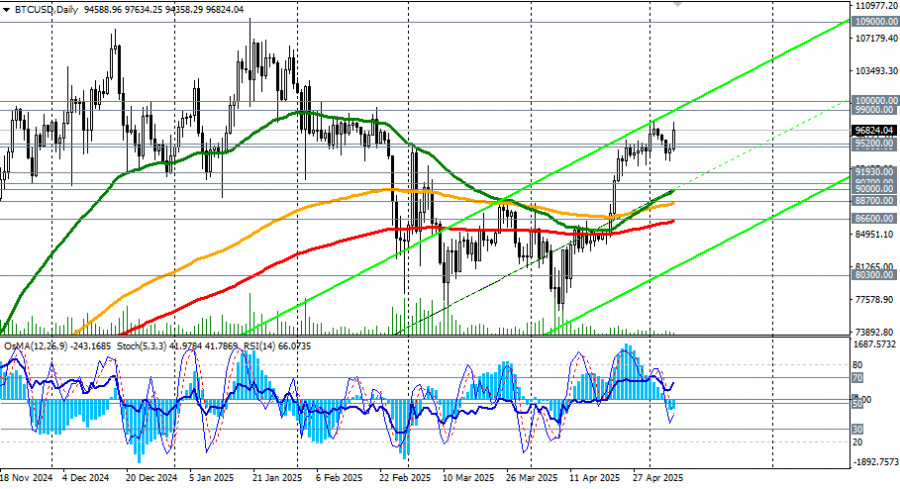

From a technical perspective, 2 out of the 4 pairs we monitor — BTC/USD and XRP/USD — remain in medium- and long-term bull markets, holding above key support levels of 86,600.00 (200-day EMA on the BTC/USD daily chart) and 2.0170 (200-day EMA on the XRP/USD daily chart).

In contrast, Ethereum and ETH/USD are still trapped in a downtrend and "depression." The instrument is trading in a medium-term bear market, below 2,426.00 (200-day EMA), and has entered a long-term bear market after breaking below 2,250.00 (200-week EMA). A significant factor behind the negative sentiment around Ethereum was the Bybit hack in February and the theft of ETH assets.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On the 4-hour chart of the Litecoin cryptocurrency, there is an appearance of a Descending Broadening Wedge pattern which indicates that there will be a strengthening in the near future

Bitcoin and Ether surged strongly during Asian trading, although yesterday ended on a somewhat downbeat note. However, despite the rapid strengthening of these assets, Bitcoin once again failed to maintain

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.