See also

09.05.2025 09:46 AM

09.05.2025 09:46 AMBitcoin has climbed above $100,000, while Ethereum is trying to consolidate above $2,000.

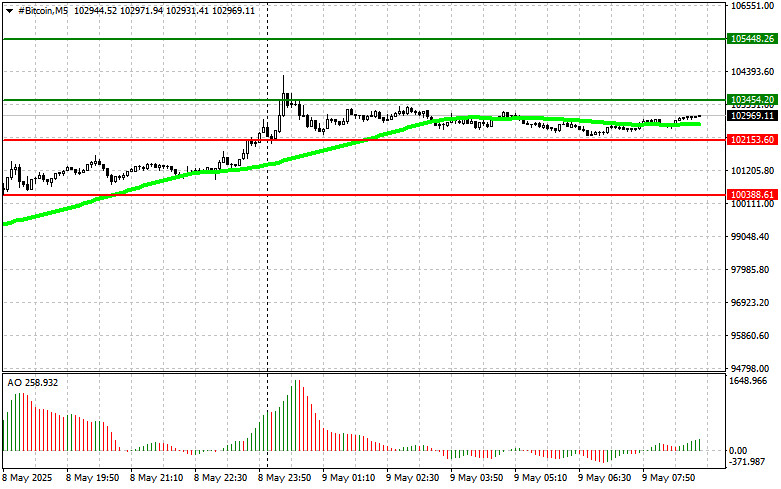

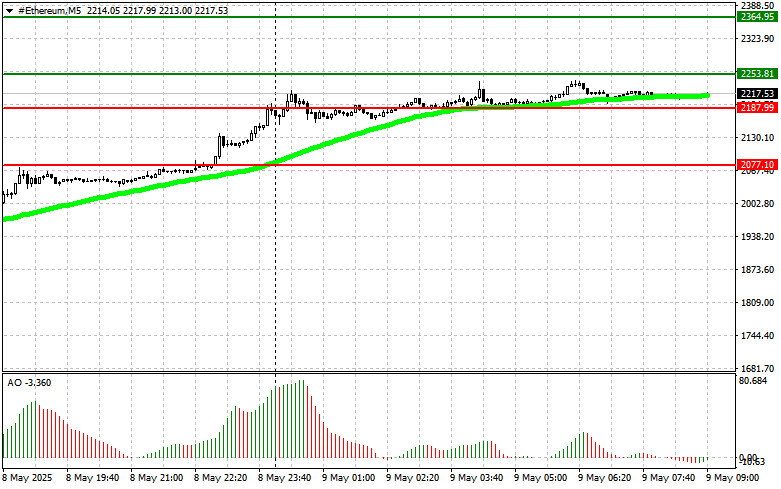

After yesterday's sharp rally, which continued during today's Asian session, Bitcoin is now trading at $103,000, having bounced off $104,700. Ethereum is hovering around $2,215, reaching $2,245 during Asian trading hours.

Many experts believe that ETH is currently significantly undervalued relative to BTC. After reaching similar ratios, ETH has historically tended to outperform BTC in price growth, as evidenced by yesterday's surge of more than 18% in a single day. However, before giving in to euphoria and diving headfirst into ETH purchases, it's important to recognize that the fundamental issues that led to Ethereum's declines over the past few quarters haven't disappeared because of the new Pectra upgrade. Whether this upgrade can truly address these issues remains to be seen. And one must not forget the inherent volatility of the cryptocurrency market, where even the most well-reasoned forecasts can miss the mark.

As for intraday strategy on the crypto market, I will continue to base my actions on any major dips in Bitcoin and Ethereum, counting on the ongoing development of a mid-term bull market.

Below is the short-term strategy and conditions.

Scenario #1: I plan to buy Bitcoin today at the entry point around $103,400, targeting a rise to $105,400. Around $105,400, I'll exit the long position and immediately sell on a pullback. Before buying on the breakout, ensure the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: If the market does not react to a breakout, Bitcoin can also be bought from the lower boundary at $102,100, with targets at $103,400 and $105,400.

Scenario #1: I plan to sell Bitcoin today at the entry point around $102,100, targeting a drop to $100,300. Around $100,300, I'll exit the short position and immediately buy on a rebound. Before selling on the breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: If the market does not react to a breakout, Bitcoin can also be sold from the upper boundary at $103,400, with targets at $102,100 and $100,300.

Scenario #1: I plan to buy Ethereum today at the entry point around $2,253, targeting a rise to $2,364. Around $2,364, I'll exit the long position and sell immediately on a pullback. Before buying on the breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: If the market does not react to a breakout, Ethereum can also be bought from the lower boundary at $2,187, with targets at $2,253 and $2,364.

Scenario #1: I plan to sell Ethereum today at the entry point around $2,187, targeting a drop to $2,077. Around $2,077, I'll exit the short position and immediately buy on a rebound. Before selling on the breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Ethereum can also be sold from the upper boundary at $2,253 if there is no market reaction to a breakout, with targets at $2,187 and $2,077.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On the 4-hour chart of the Litecoin cryptocurrency, there is an appearance of a Descending Broadening Wedge pattern which indicates that there will be a strengthening in the near future

Bitcoin and Ether surged strongly during Asian trading, although yesterday ended on a somewhat downbeat note. However, despite the rapid strengthening of these assets, Bitcoin once again failed to maintain

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.