See also

22.05.2025 05:06 AM

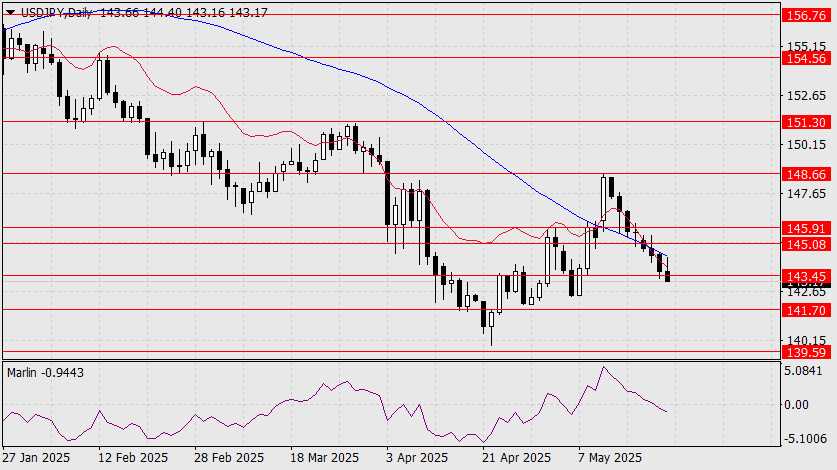

22.05.2025 05:06 AMThe USD/JPY pair has been declining for eight consecutive days — a pattern not seen since 2019. However, we recently saw two five-week declines in July 2024 and November–December 2023, which suggests the yen may be preparing for something significant. This is further supported by the fact that, on the daily chart, the price has consolidated below key indicator lines, and the Marlin oscillator has moved below the zero line.

The nearest bearish target is 141.70 — a goal for the end of Friday. After that, if the market desires, the price could consolidate for 1–2 days and continue falling toward 139.59, the low from September 16, 2024.

The price is preparing to consolidate below the 143.45 level on the four-hour chart. Once that occurs, the pair will likely continue its downward movement. The Marlin oscillator has been consolidating for a reasonably long period (shown in a gray rectangle), which is creating room for a further decline into oversold territory.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.