See also

23.05.2025 05:27 PM

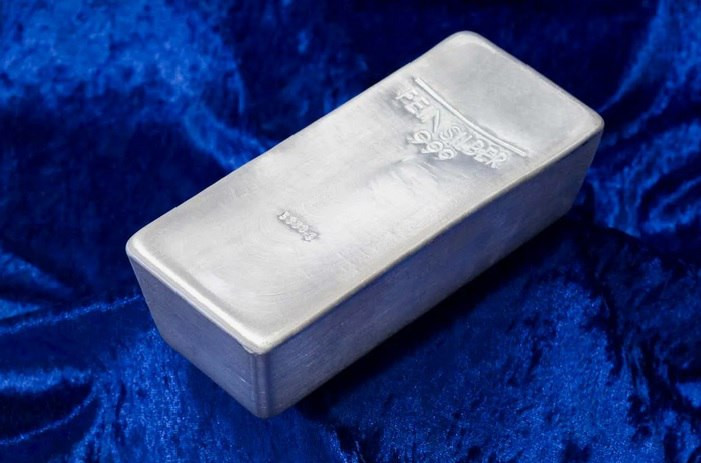

23.05.2025 05:27 PMSilver is regaining positive momentum, maintaining control above the key psychological level of $33.00. The emergence of buying on declines confirms that this week's breakout above the upper boundary of a nearly month-long range can be seen as a bullish trigger. Moreover, oscillators on the daily chart have begun to turn positive, supporting the short-term outlook for further gains in the XAG/USD pair.

Additional buying beyond the $33.70 resistance—this month's high and a level last seen in April—would confirm the bullish trend, allowing the white metal to target the key psychological level of $34.00. A continued upward move has the potential to push XAG/USD toward the yearly high.

On the other hand, weakness below the $32.00 level could be viewed as a buying opportunity, but such interest would likely be limited to the $32.60 level, which serves as a key support level. A decisive break below this area would expose the 100-day Simple Moving Average (SMA), currently positioned just above $32.00. Further downside pressure could make XAG/USD vulnerable to testing the $31.40 level. A clear break below this level would invalidate the bullish outlook, shifting the short-term bias in favor of the bears.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.