See also

23.05.2025 12:16 PM

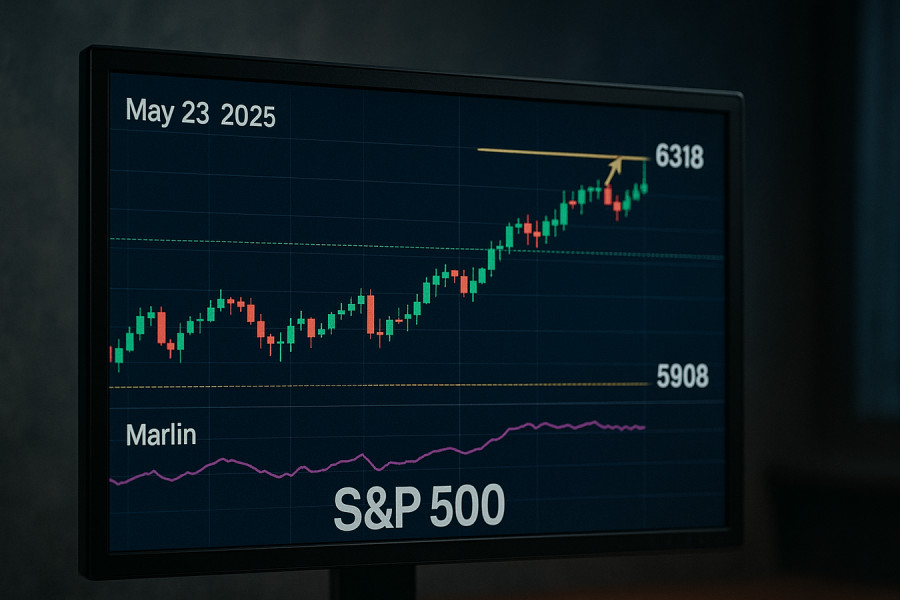

23.05.2025 12:16 PMThe May 23 outlook for the S&P 500 suggests consolidation just below the resistance level near 5,908. Under favorable conditions, the index has the potential to rise towards the 6,318 mark, possibly initiating a new wave of the broader uptrend.

However, technical indicators warrant caution: the Marlin oscillator is showing a decline in its signal line, pointing to a potential local correction. Investors are advised to tread carefully amid the current technical uncertainty.

Follow the link for details.

The House of Representatives has approved Donald Trump's tax-cut proposal, which in theory should boost economic activity. Yet markets reacted with caution, wary of a potential surge in the federal deficit and renewed pressure on the bond market.

Rising Treasury yields are accelerating capital outflows from equities, triggering a pullback in the S&P 500 and other major indices. Despite some positive headlines, fiscal risks continue to cast a shadow over the market, fostering an environment of uncertainty.

Follow the link for details.

As a reminder, InstaTrade offers the best conditions for trading stocks, indices, and derivatives, helping you profit effectively from market swings.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.