See also

28.05.2025 05:08 AM

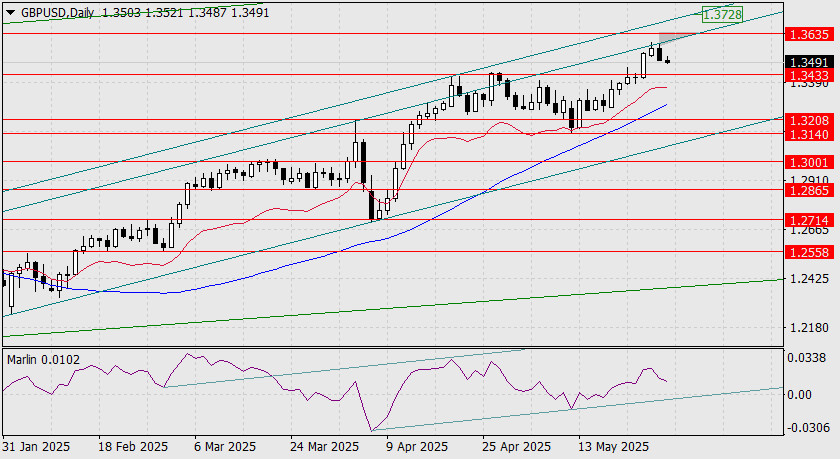

28.05.2025 05:08 AMOn Tuesday, the British pound hesitated to enter the narrow wedge between the price channel line and the target level 1.3635. In the context of a 0.42% strengthening of the U.S. dollar index, such an attempt would likely have failed.

The price is now undergoing a consolidation phase to better prepare for an eventual upward move. Breaking through a wedge at its narrowest point—especially at the "magnetic" apex of the wedge—is even more challenging. The declining Marlin oscillator currently allows for a test of the 1.3433 support level. Once the correction is complete, we expect the price to head toward the upper boundary of the price channel near 1.3728.

On the four-hour chart, the price faces three support levels: the lower boundary of the local price channel, the 1.3433 support level, and the MACD line.

Overcoming this cluster of support levels without significant catalysts (currently absent) is highly unlikely. Therefore, we expect the correction to end soon and the British pound's upward movement to resume.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.