See also

10.06.2025 10:44 AM

10.06.2025 10:44 AMMarkets have virtually come to a standstill in anticipation of the outcome of the trade negotiations between representatives of China and the United States. So far, there have been no results, which is causing investor anxiety and increased volatility, as neither side has reported any progress in the negotiation process.

The first day of talks ended without any results, and now markets are waiting for at least some outcome from the second day. Whether there will be one remains an open question. Meanwhile, market participants are focusing on the possibility of a positive outcome. Against this backdrop, the U.S. dollar is receiving some—albeit weak—support.

It seems the Chinese have found America's Achilles' heel: its dependence on rare earth metal supplies, the vast majority of which are produced in China and are critically important for U.S. high-tech industries. Hopes for a truce in the trade war between the world's two largest economies are helping the dollar, which previously came under pressure due to Donald Trump's policies that undermined investor confidence in U.S. assets.

It's unlikely that a major breakthrough will be achieved, but even a modest positive outcome would be welcomed by the markets and could serve as a basis for upward momentum in the U.S. dollar on the Forex market. Additional support for the greenback may come if tomorrow's consumer inflation report shows an increase, pushing back expectations for an early resumption of Federal Reserve rate cuts.

How might the markets react overall to even a modestly positive outcome from the negotiations?

I believe that both the U.S. dollar and equity markets, along with the cryptocurrency market, will experience optimism and begin to rise again. This positive sentiment may not be dampened by the expected rise in U.S. inflation, which will be reported tomorrow (Wednesday). That's because the biggest current threat to the markets is the tariff war. If that de-escalates and loses its absurd edge, it would be a powerful signal for renewed demand for risk assets.

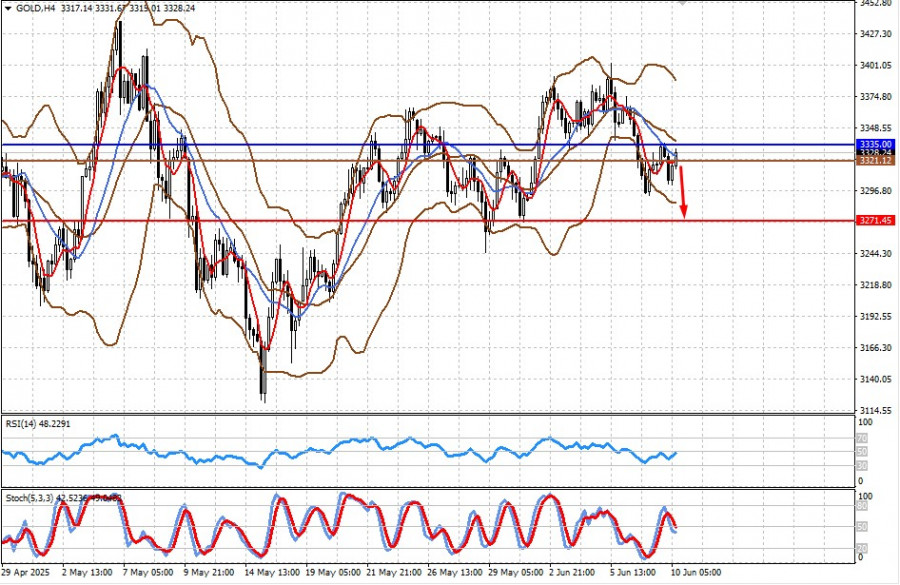

Gold

Gold prices are consolidating below the level of 3335.00. Rising U.S. inflation and the potential for even partial agreements between China and the U.S. on mutual trade could push the price of the yellow metal down to 3271.45. The 3321.12 mark may serve as a selling trigger.

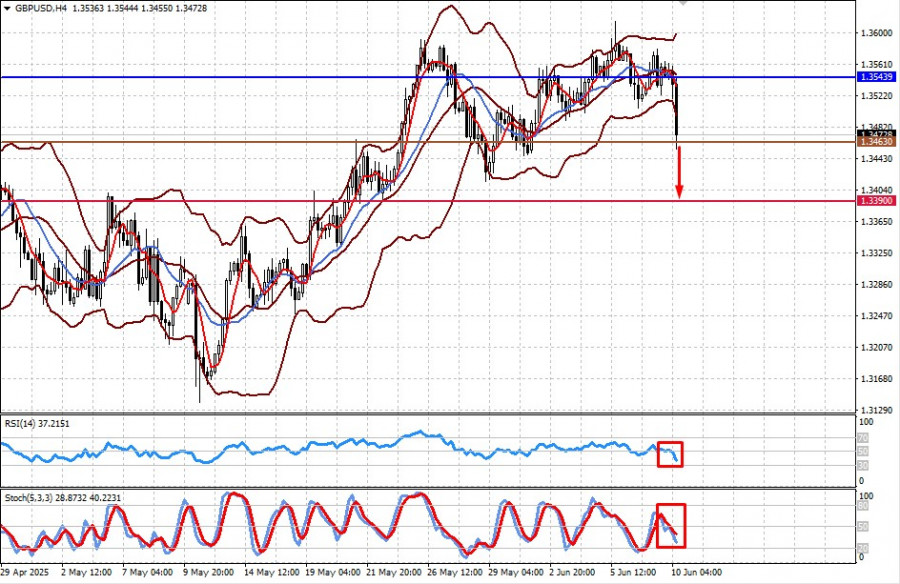

GBP/USD

The pound is under pressure from negative labor market data in the United Kingdom, which increases the likelihood of renewed rate cuts. Additionally, the pair is negatively affected by the strengthening dollar. Today's decline will likely continue. Against this background, we should expect it to fall to 1.3390. The level for selling the pair may be 1.3463.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.