See also

11.06.2025 11:47 AM

11.06.2025 11:47 AMToday, the market's main focus will be the release of the U.S. inflation report, which is expected to show not only a halt in the recent decline but the highest increase in inflation over the past four months.

According to the consensus forecast, the annual headline consumer inflation rate is expected to rise from 2.3% to 2.5%, while core inflation is projected to increase from 2.8% to 2.9%. This is a negative signal for tokens and a positive one for the U.S. dollar, which will likely put pressure on Bitcoin's price against the dollar.

Technical Picture and Trade Idea

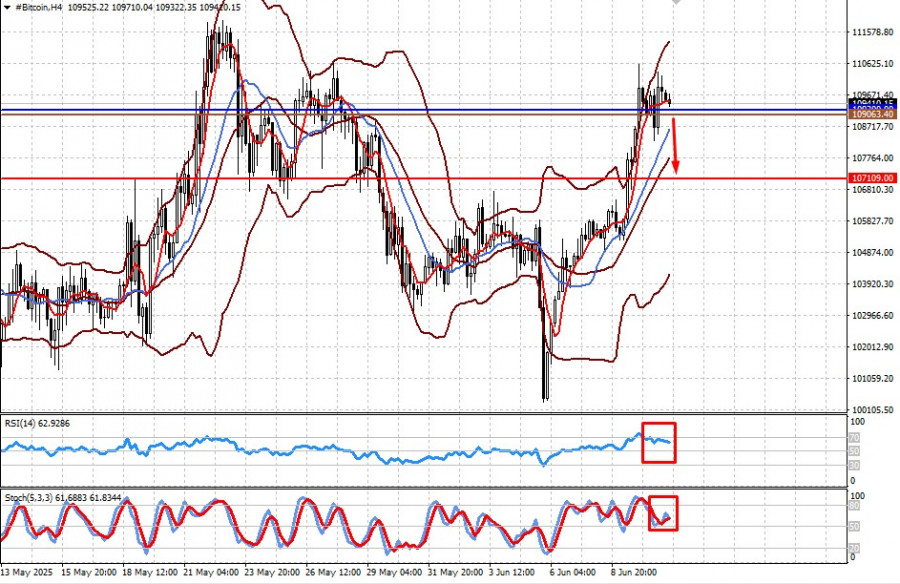

The price remains close to its all-time high, consolidating just below the psychological level of 100,000.00. Dollar strength may lead to a reversal and a corrective decline.

The price is above the midline of the Bollinger Bands, at the level of the 5-day SMA and above the 14-day SMA. The RSI is below the overbought zone and moving sideways. The Stochastic indicator is above the 50% level but currently lacks informational value.

A drop below the 100,200.00 level could lead to a decline in Bitcoin's price toward 107,109.00. A probable entry point may be considered around 109,063.40.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.