See also

12.06.2025 08:22 AM

12.06.2025 08:22 AMThe Euro, Pound, Yen, and Other Currencies Soar Against the U.S. Dollar — And There Were Objective Reasons for It

Following the release of inflation data that came in below economists' forecasts, the U.S. dollar quickly lost ground, allowing the euro, pound, and other risk-related assets to strengthen. Traders interpreted the report as a signal of a potential continuation of the Federal Reserve's interest rate cut cycle, thereby reducing the dollar's appeal. However, despite the markets' positive response, some caution remains. While inflation is slowing, it remains above the Fed's 2% target, suggesting the Fed is likely to maintain its wait-and-see approach at least through the end of this summer.

Today, there are no significant reports from the eurozone, so market participants will focus on a speech by Isabel Schnabel, a representative of the European Central Bank. Her comments, particularly on future monetary policy, may impact euro dynamics. A confirmation of expectations regarding a pause in interest rate cuts may act as a catalyst to maintain yesterday's bullish momentum, reinforcing the euro's position against the dollar.

As for the pound, today's session will feature the release of UK GDP, industrial production, and manufacturing output data. Disappointing figures could immediately weigh on the pound. If the economic indicators fall short of expectations, the Bank of England may be forced to resume interest rate cuts, weakening the pound's position. At the same time, surprisingly strong data may offer short-term support.

If the data aligns with economists' expectations, a Mean Reversion strategy is recommended. If the results deviate significantly from forecasts—either above or below—a Momentum strategy would be more appropriate.

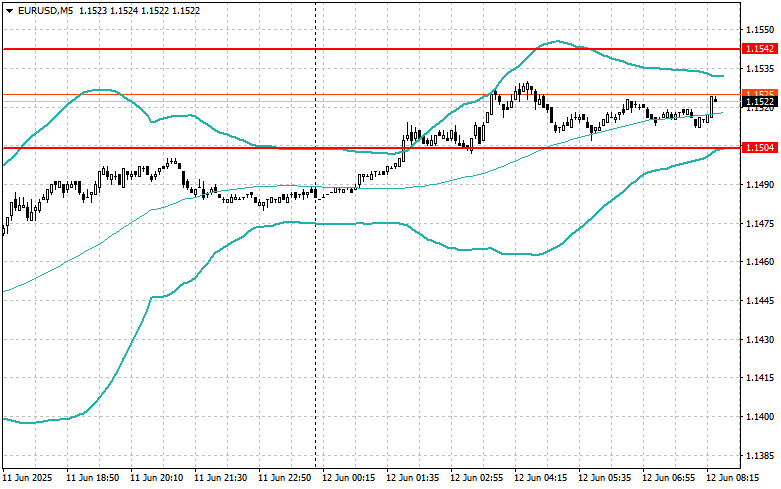

Buy on breakout above 1.1530, targeting 1.1571 and 1.1624;

Sell on breakout below 1.1491, targeting 1.1451 and 1.1408.

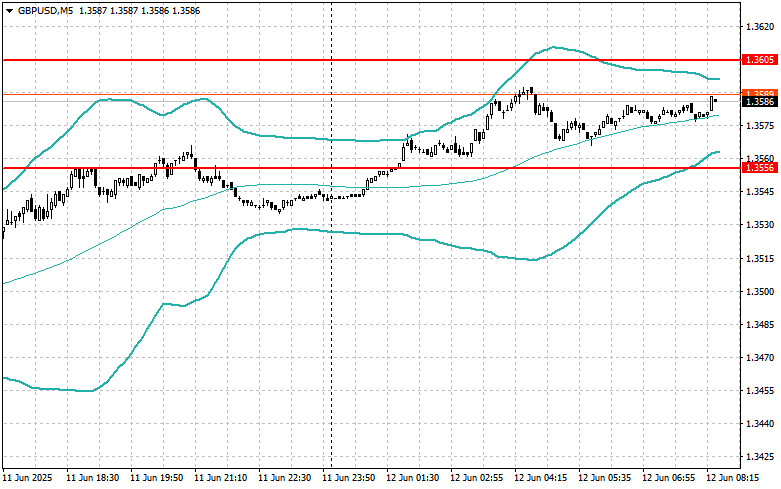

Buy on breakout above 1.3590, targeting 1.3620 and 1.3660;

Sell on breakout below 1.3560, targeting 1.3530 and 1.3500.

Buy on breakout above 144.10, targeting 144.55 and 144.92;

Sell on breakout below 143.60, targeting 143.25 and 142.80.

Look to sell after a failed breakout above 1.1542 followed by a return below this level;

Look to buy after a failed breakout below 1.1504 followed by a return above this level.

Look to sell after a failed breakout above 1.3605 followed by a return below this level;

Look to buy after a failed breakout below 1.3556 followed by a return above this level.

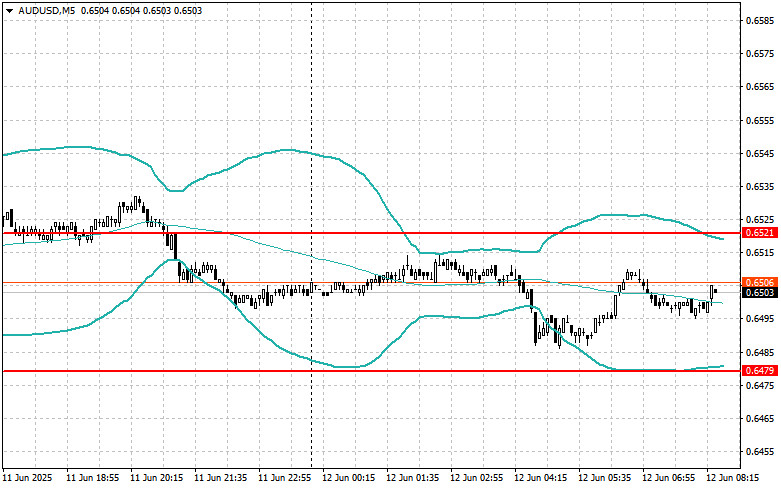

Look to sell after a failed breakout above 0.6521 followed by a return below this level;

Look to buy after a failed breakout below 0.6479 followed by a return above this level.

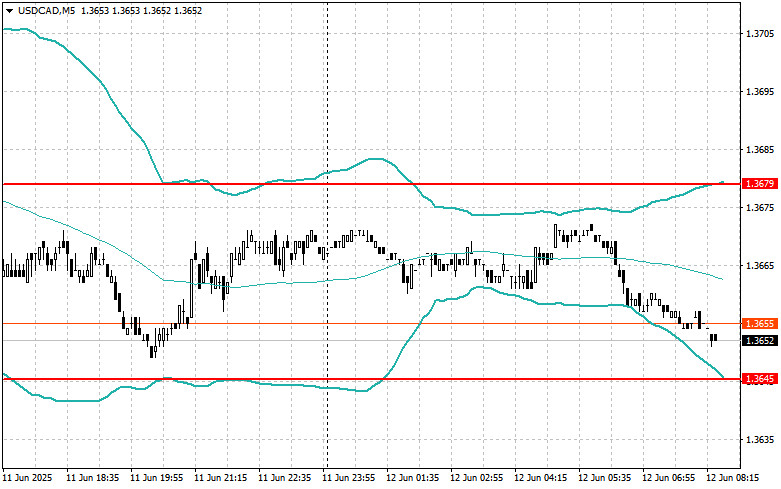

Look to sell after a failed breakout above 1.3679 followed by a return below this level;

Look to buy after a failed breakout below 1.3645 followed by a return above this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.