See also

23.06.2025 07:08 PM

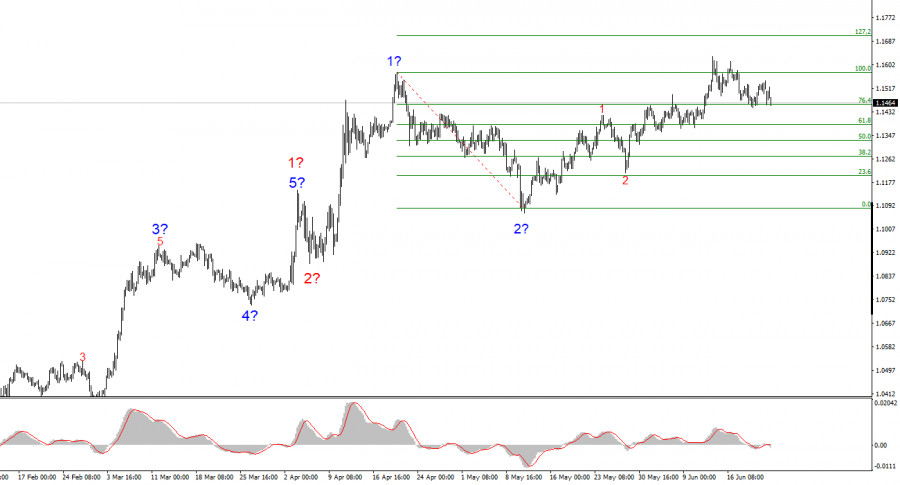

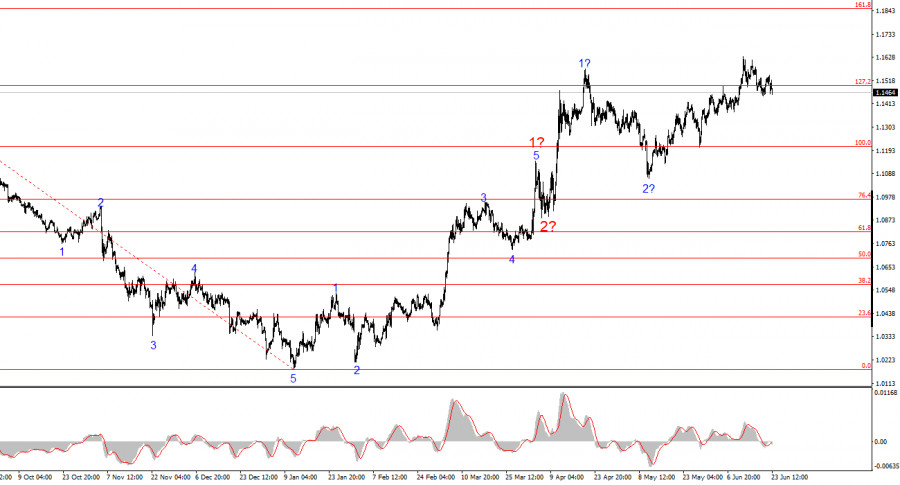

23.06.2025 07:08 PMThe wave pattern of the 4-hour EUR/USD chart continues to indicate the development of an upward trend segment. This transformation occurred exclusively due to the new U.S. trade policy. Until February 28, when the U.S. dollar started to decline, the wave structure looked like a convincing downward trend segment. A corrective wave 2 was forming. However, Donald Trump's trade war—intended to increase budget revenues and reduce the trade deficit—is so far working against the U.S. dollar. Demand for the dollar began to fall sharply, and now the entire trend segment that started on January 13 has taken on an impulsive upward form.

At present, wave 3 within wave 3 is presumably still developing. If this is the case, price increases will likely continue in the coming weeks and months. However, the dollar will remain under pressure only if Donald Trump does not completely reverse the trade policy he adopted. There is little chance of that, and currently, there is no reason to expect strong growth in the dollar.

EUR/USD rose by 20 basis points on Monday. The market was not overly impressed by developments in the Middle East. In other words, market participants were already prepared for the conflict, its escalation, and potential U.S. involvement. The U.S. doesn't launch strikes on other countries every day, but Donald Trump has repeatedly warned Iran.

However, Iran has been hearing threats and warnings for decades. This no longer surprises anyone in the country. I was only slightly surprised that Trump didn't wait for the two-week deadline he had announced for deciding on Iran but carried out a strike just a few days later. But that is characteristic of the U.S. president. In my opinion, the market had no real reason to increase demand for the dollar. It's important to understand that America is now a full participant in the Middle East conflict, which means the dollar can no longer be considered a "safe haven." What kind of "safe haven" is a country actively involved in a war? The market had already been paying more attention to the euro, pound, and franc—and may now rush to buy these currencies with even greater force. The lower their prices, the more attractive they are for buyers.

Economic news released Monday received little attention. The PMI indices for the services and manufacturing sectors in the Eurozone and Germany in June showed no positive dynamics. But the market focused all day not on economic reports, but on developments in the Middle East. And there was a lot to follow.

Based on the analysis of EUR/USD, I conclude that the pair is continuing to build an upward trend segment. The wave structure still depends entirely on the news background, particularly related to Trump's decisions and U.S. foreign policy. The targets for wave 3 could extend up to the 1.2500 le. Therefore, I continue to consider buying opportunities with initial targets around 1.1708, which corresponds to the 127.2% Fibonacci level. A de-escalation of the trade war could reverse the upward trend, but for now, there are no signs of either a reversal or de-escalation. The war between Israel and Iran has only paused the dollar's decline—I do not believe it will end it.

On the higher wave scale, the structure has shifted to an upward direction. A long-term bullish sequence of waves is likely ahead, but news—especially from Donald Trump—can still turn everything upside down once again.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

GBP/USD Analysis: The British pound continues its downward movement, which began a month ago. After breaking a strong intermediate support level last week, the pair rebounded, forming a correction along

EUR/USD Analysis:The upward trend in the main euro pair, which began in February this year, has brought the quotes to the lower boundary of a broad potential reversal zone

Ferrari F8 TRIBUTO

from InstaTrade

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.