See also

01.07.2025 05:15 AM

01.07.2025 05:15 AMOil (CL)

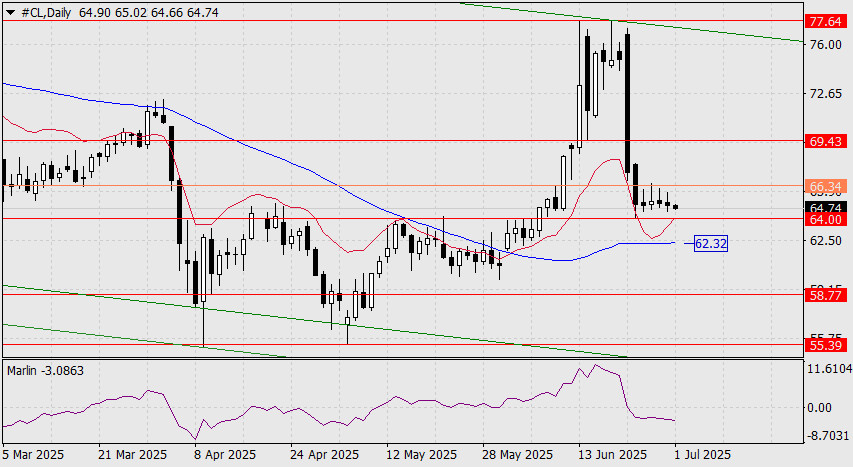

The current situation suggests the end of a 4-day consolidation above the 64.00 level. Breaking through this support will allow the price to attack the MACD line near 62.32.

Further development may lead to a move toward 58.77. The declining Marlin oscillator has consistently indicated this scenario.

In the four-hour timeframe, Marlin exhibits a different sentiment — one of growth amid consolidation.

However, with the balance and MACD indicator lines declining and amid a sharp price drop, this growth is interpreted as a release of tension — an exit from the oversold zone ahead of a continued downward movement. Once the price moves below the 64.00 level, Marlin will shift into negative territory.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.