See also

09.07.2025 11:35 AM

09.07.2025 11:35 AMThe AUD/USD pair is holding steady at current levels with a bullish bias but limited movement following the release of inflation data from China—Australia's key trading partner.

In June, China's Consumer Price Index (CPI) rose 0.1% year-over-year, following a 0.1% decline in May. Meanwhile, monthly CPI declined by 0.1%, and the Producer Price Index (PPI) fell by 3.6% year-over-year, worse than the expected -3.2%. These figures point to ongoing price pressure in the Chinese economy.

The Australian dollar was also affected by comments from Reserve Bank of Australia (RBA) Governor Michele Bullock, who highlighted persistent inflation risks due to high labor costs and low productivity. She also noted that the full impact of the previous 50-basis-point rate cuts has yet to be realized. At its most recent meeting, the RBA kept the official interest rate at 3.85%. According to a Reuters poll, economists expect the RBA to cut the official rate by 25 basis points to 3.60% in August.

RBA Deputy Governor Andrew Hauser stated that the global economy faces enormous uncertainty and that the tariffs introduced by Donald Trump are significant for the global economy and will put pressure on growth.

From a technical perspective, the Relative Strength Index (RSI 14) is slightly above 50, confirming a moderately bullish sentiment. However, the price has yet to break above the 9-day EMA (around 0.6535), indicating limited short-term momentum.

The key resistance level is the 9-day EMA at 0.6535; a successful breakout above this level could strengthen bullish momentum and bring the price closer to the eight-month high of 0.6590, recorded on July 1. The next target would be the psychological level of 0.6600.

In the event of a pullback, support lies at the Asian session low near 0.6510, followed by the psychological level of 0.6500 and the 50-day SMA. A break below these levels would weaken the pair, potentially bringing it down to the 0.6400 level and testing the two-month low around 0.6372.

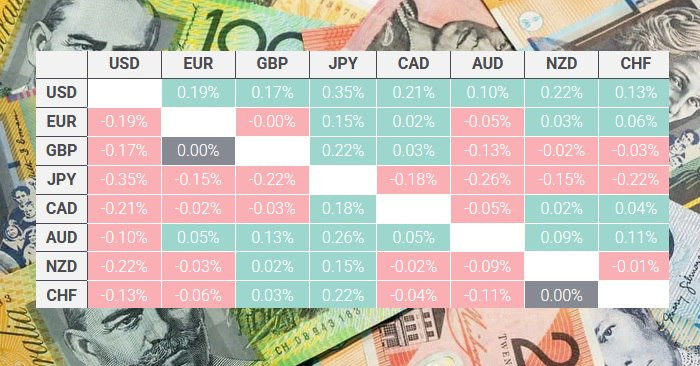

The table shows the percentage change in the Australian dollar against major currencies for today. The Australian dollar was the weakest against the U.S. dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.