See also

10.07.2025 06:14 AM

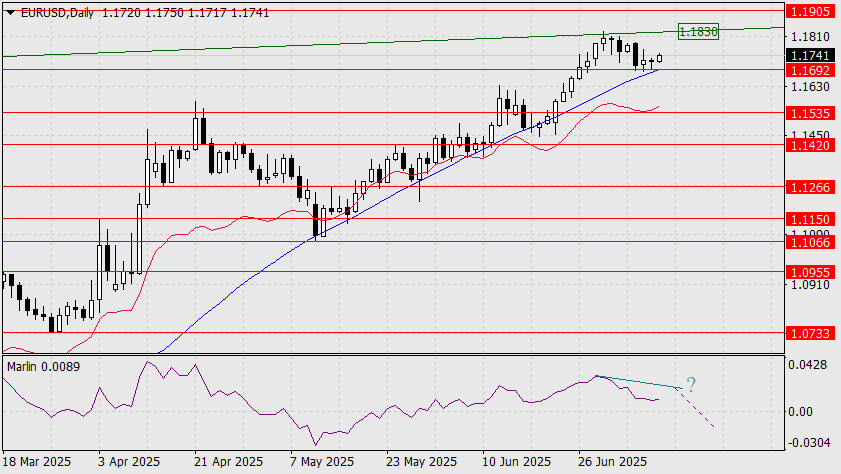

10.07.2025 06:14 AMMarkets continue to test risk-on strategies—yesterday, the S&P 500 rose by 0.61%, oil slipped by 0.22%, and the euro declined by just 4 points, which, given the low daily volatility, can be considered a neutral result. After rebounding from the 1.1692 level yesterday, the euro is showing stronger gains this morning (+20 points). The price has likely opted to retest the upper boundary of the price channel at 1.1830.

This scenario could lead to a divergence forming between the price and the Marlin oscillator. However, it may not materialize—meaning the price might not reach the target—since divergence is already present on the weekly timeframe. A rally in the stock market to new all-time highs could pull the euro upward.

On the H4 chart, the Marlin oscillator's signal line has settled in positive territory. The price's growth is currently being held back by the balance line (red), and just above it lies the MACD line at 1.1780. The last time the price approached this line (gray square), it failed to break through its resistance. Overall, the price is moving sideways and waiting for new external catalysts.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.