See also

23.07.2025 11:53 AM

23.07.2025 11:53 AMOn Wednesday during the Asian session, the AUD/JPY pair posted solid gains, extending a moderate rebound from the two-week low recorded the day before. However, spot prices have slightly pulled back from the session highs reached earlier and are currently trading around 96.50, up 0.20% from the start of the day.

The Japanese yen is weakening against all major currencies, not just the Australian dollar, following reports that Prime Minister Shigeru Ishiba may resign by the end of August. This adds to political uncertainty, which, combined with a generally optimistic market sentiment, is undermining the yen's safe-haven status and supporting AUD/JPY for a second consecutive day. Still, expectations of a U.S.–Japan trade agreement are holding back yen bears from aggressive selling, thus limiting further gains in the currency pair.

At this point, U.S. President Donald Trump has already announced that a trade deal with Japan has been reached, stating that Japan has agreed to reciprocal tariffs of 15% and will open its market to U.S. automobiles—both passenger and commercial—as well as rice and other agricultural products. This news helps ease concerns about potential negative consequences from U.S. tariff hikes, thereby limiting further yen depreciation. In addition, the dovish stance of the Reserve Bank of Australia (RBA) continues to put pressure on further upside for the AUD/JPY pair.

The minutes of the RBA's July meeting, released Tuesday, show that three board members supported cutting interest rates due to expectations that inflation would return to the 2% target. Traders are increasingly confident that the RBA will lower rates in August amid signs of easing in the labor market. This sets the stage for caution ahead of new AUD purchases in the AUD/JPY pair and potential continuation of the recent uptrend.

From a technical perspective, the price is currently near resistance at 96.55, where the 50-period SMA lies on the four-hour chart. A break above this level would open the way toward the next barrier at the psychological level of 97.00, followed by the monthly high. On the other hand, the pair could retreat to 96.36, with further support seen at the 96.00 psychological mark.

However, as long as oscillators on the daily chart remain in positive territory, a decline is unlikely.

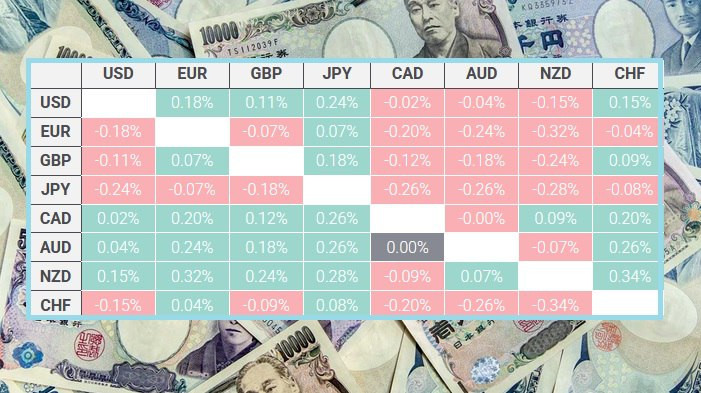

Below is a table showing the percentage change in the Japanese yen against major currencies for today.

The yen is currently showing the most strength against the euro.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.