See also

30.07.2025 09:24 AM

30.07.2025 09:24 AMUS stock indices ended last Friday in decline. The S&P 500 dropped by 0.30%, and the Nasdaq 100 fell by 0.30%. The Dow Jones Industrial Average lost 0.46%.

Asian equities edged higher this morning as the extension of the tariff truce between the US and China provided investors with some relief, averting an immediate escalation. This has certainly helped ease tensions amid ongoing uncertainty that has recently weighed on markets. Investors are enjoying a brief reprieve, allowing them to reassess risks and opportunities in the current environment. However, the euphoria over the truce may be short-lived. Fundamental issues in trade relations between the world's two largest economies remain unresolved. Matters such as intellectual property rights, market access, and enforcement mechanisms still require thorough negotiation and mutually beneficial compromises.

The MSCI regional equity index rose by 0.5%, driven mainly by gains in tech stocks. Futures on the S&P 500 climbed 0.2% after the index recorded its first daily drop in seven sessions on Tuesday. European contracts rose 0.3%. The US dollar fell against all its G10 peers, with many expecting the Federal Reserve to leave interest rates unchanged at today's meeting. Oil prices posted their biggest gain in six weeks.

President Donald Trump is preparing to make a final decision on whether to maintain the tariff truce with China, which is set to expire in two weeks. A renewal would signal further stabilization in US–China relations. Much like the muted reaction to the US–EU tariff agreement, the latest signs of progress with Beijing led to only modest equity gains and failed to significantly lift investor sentiment.

Yesterday, Trump also announced that he would give Russia ten more days to reach a ceasefire with Ukraine, formally setting a new deadline to pressure Vladimir Putin. However, even the threat of secondary sanctions is unlikely to bring a swift end to the conflict.

Meanwhile, Trump warned that India could face a tariff rate of 20–25%, although he noted that the final duty rate has not yet been determined, as the two countries continue negotiations on a trade agreement ahead of the August 1 deadline.

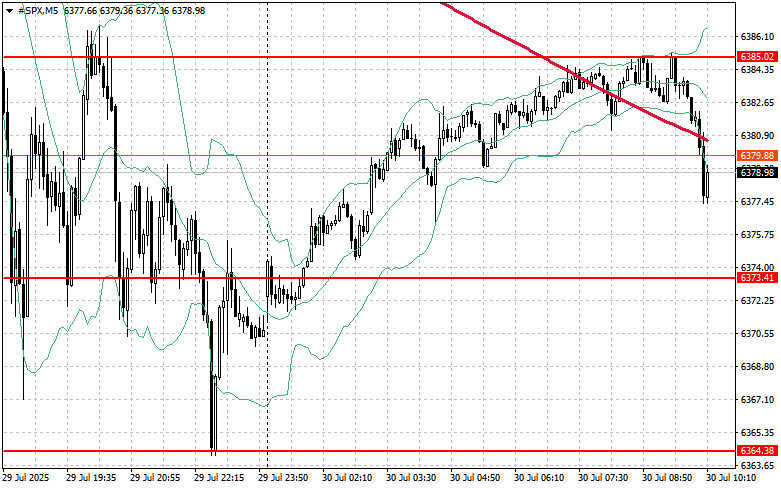

Today, buyers of the S&P 500 will aim to overcome the nearest resistance at $6,385. A breakout here would confirm upward momentum and open the path toward $6,392. Another key priority for the bulls is to gain control above $6,400, which would further strengthen their position. If the index retreats amid declining risk appetite, buyers must show presence around the $6,373 area. A breakdown of that level could quickly push the instrument back to $6,364 and possibly extend the slide toward $6,355.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.