See also

05.08.2025 01:16 PM

05.08.2025 01:16 PMToday, the British pound was traded using the Mean Reversion strategy, while the Japanese yen could be traded using a Momentum approach.

The Eurozone Services PMI for July was revised downward, which put pressure on the euro in the first half of the day. The final index reading published by S&P Global came in at 51.0, below the preliminary estimate. This indicates a slowdown in growth in the services sector, which is a key driver of the euro area economy. While the index remains above the 50-point threshold that separates expansion from contraction, the downgrade reinforces concerns about the region's economic outlook.

Today, the U.S. ISM Services PMI, Composite PMI, and Trade Balance data are due. Strong figures could help ease concerns about a potential economic slowdown. The ISM Services PMI is a key indicator of the health of the U.S. economy. If the figure exceeds expectations, it will signal continued growth in the services sector, which is a positive development. The Composite PMI, which combines data from both manufacturing and non-manufacturing sectors, will offer a broader picture of economic activity. A positive trend would confirm the economy's resilience. The trade balance also plays a significant role: a narrowing deficit or a shift to a surplus would indicate rising exports and, in turn, domestic production growth.

If the data is strong, I will rely on Momentum strategy setups. If the market shows little reaction, I will continue using the Mean Reversion strategy.

Momentum Strategy (Breakout) for the Second Half of the Day:

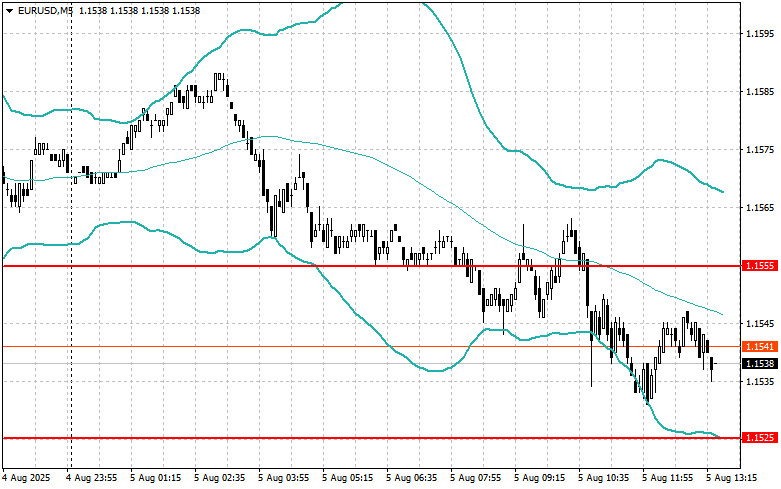

EUR/USD

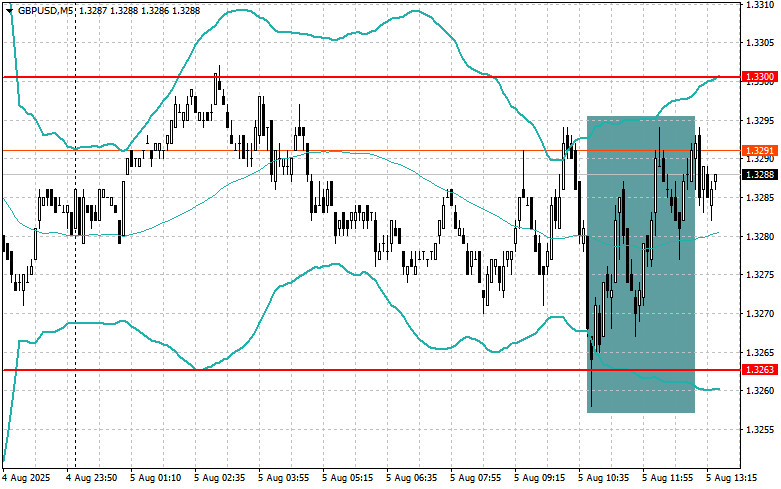

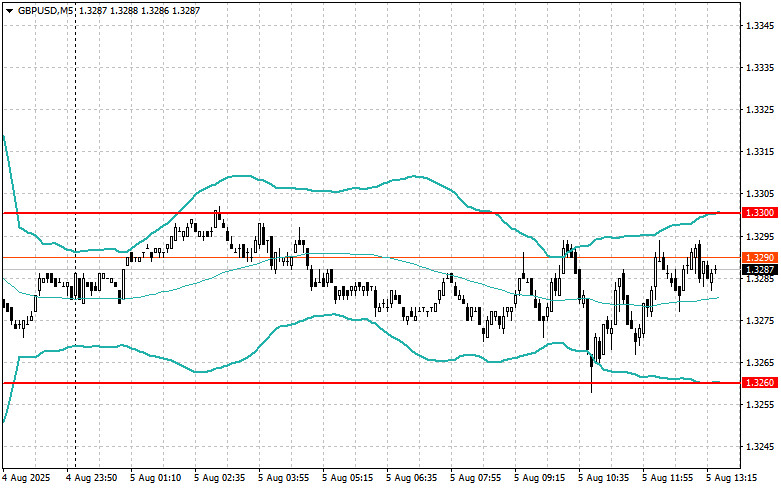

GBP/USD

USD/JPY

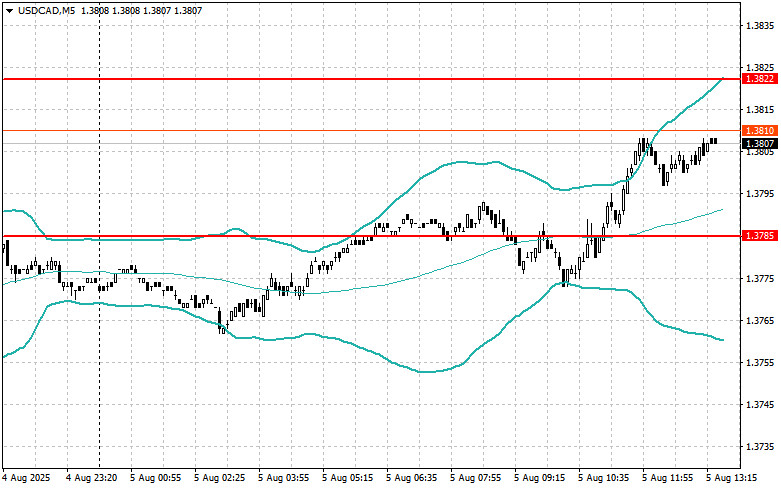

Mean Reversion Strategy (Pullback) for the Second Half of the Day:

EUR/USD

GBP/USD

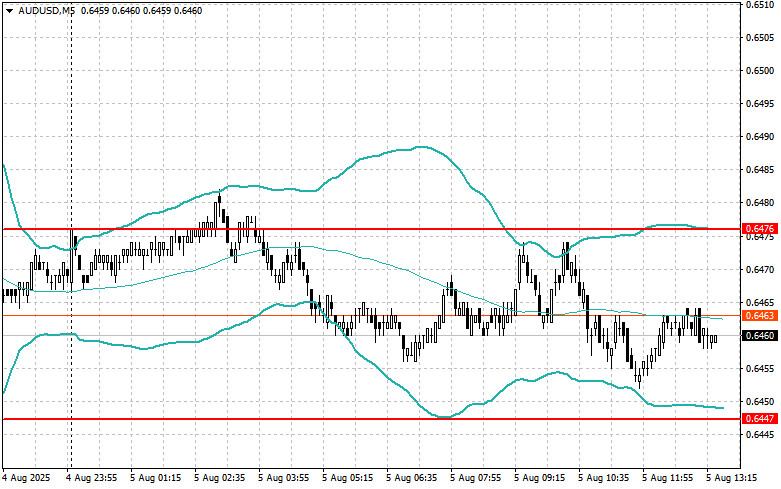

AUD/USD

USD/CAD

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.