See also

07.08.2025 05:07 AM

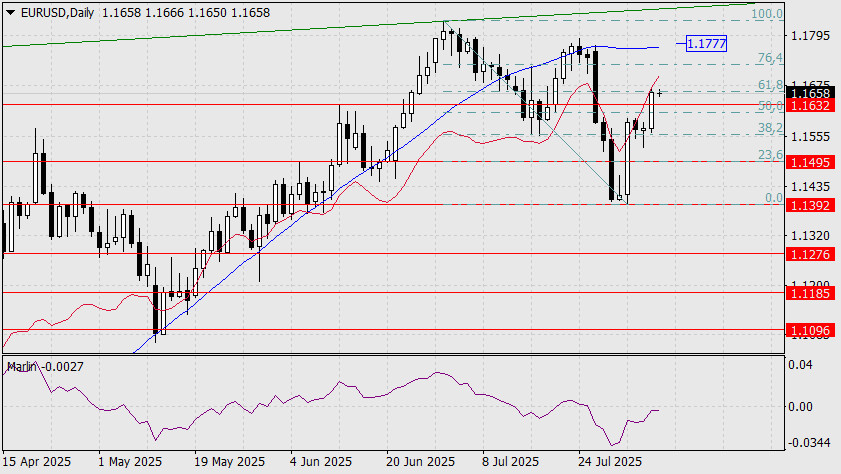

07.08.2025 05:07 AMAs a result of yesterday's 84-pip rise, the euro broke above the target level of 1.1632, testing the balance indicator line. The correction from the downward move that began on July 1 reached 61.8%. However, the Marlin oscillator's signal line has not yet moved into positive territory, which means a price reversal below 1.1632 remains possible. A consolidation below this level would return the quote to 1.1495.

If today closes above yesterday's high and Marlin moves into the growth zone, the price is likely to continue rising toward the MACD line near 1.1777. Only a firm hold above this level would allow the pair to break through the upper boundary of the green price channel.

The downward movement also faces strong resistance levels: the four-hour MACD line, the Marlin oscillator's trend boundary (which is still a fair distance away), and the support level at 1.1495.

As a result, the euro has widened its zone of uncertainty: 1.1495–1.1777. However, in the current situation, we expect a correction of the upward move from August 1, approximately toward 1.1565 (the 38.2% Fibonacci retracement level and the July 17 low).

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.