See also

07.08.2025 10:12 AM

07.08.2025 10:12 AMToday, the central bank of the United Kingdom – the Bank of England – will hold its policy meeting. The central bank is expected to cut the key interest rate by 0.25%, from 4.25% to 4.00%, in response to falling inflation and worsening economic conditions in the country. This could have a notably negative impact on the GBP/USD pair, despite the apparent weakness of the U.S. dollar due to growing expectations of a Federal Reserve rate cut at its September meeting. However, the downside may be limited.

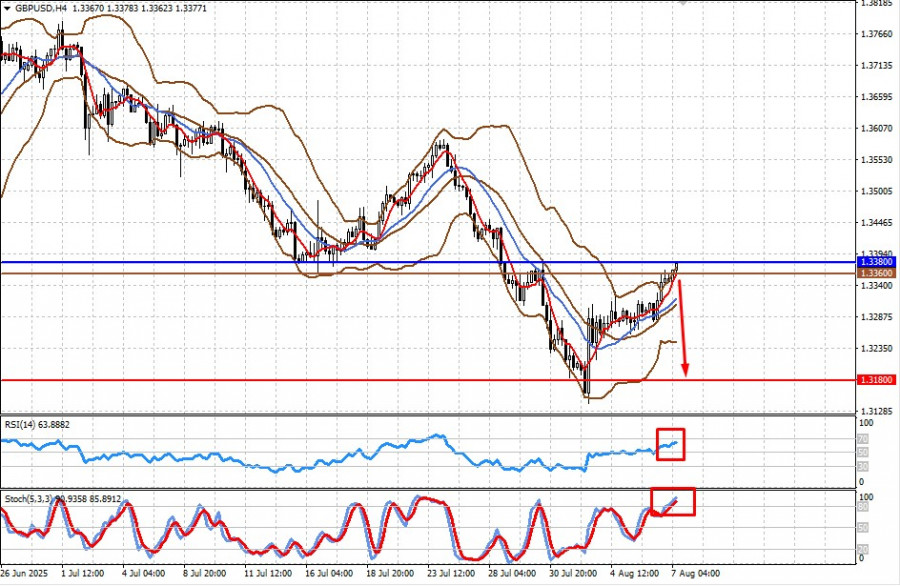

From a technical standpoint, the price is testing the local resistance level at 1.3380. If it fails to break above it, or rises above and then drops back below it, a limited decline in the pair should be expected.

The price is trading above the upper Bollinger Band, above the 5-day and 14-day SMAs. The RSI is above the 50% level and continues to rise. The Stochastic indicator is already in overbought territory.

Failure of the pair to hold above the 1.3380 level may lead to a corrective decline toward 1.3180. The 1.3360 level could serve as an entry point for selling the pair.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.