See also

08.08.2025 12:49 AM

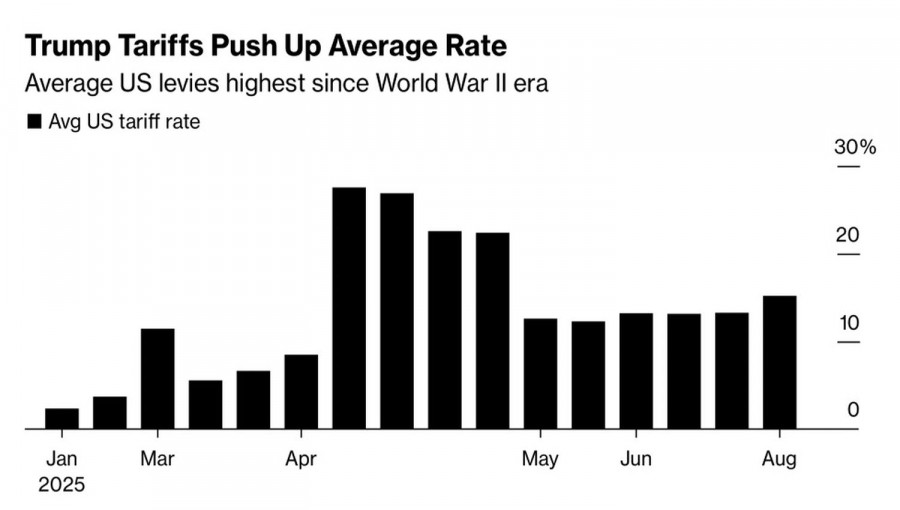

08.08.2025 12:49 AMEuphoria fades quickly. Financial markets were initially relieved that Donald Trump's tariffs turned out to be lower than anticipated back on America's Liberation Day in April. However, according to Bloomberg's calculations, the average tariff rate has risen from 2.3% in 2024 to 15.2%—the highest level since World War II. How will the global economy cope with that? Investors are gradually coming back down to earth and locking in profits on long EUR/USD positions.

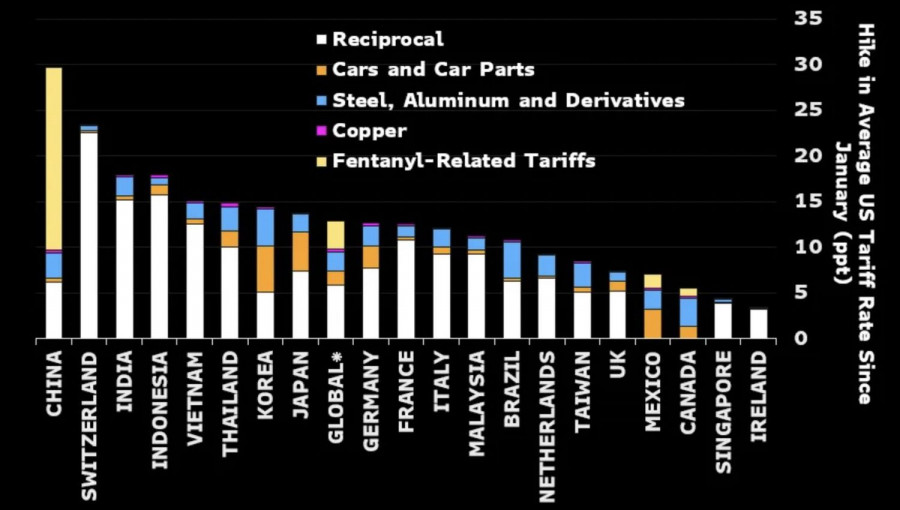

In reality, trade uncertainty has decreased, but it hasn't disappeared. The doubling of tariffs on imports from India to 50% due to Delhi's purchases of Russian oil, the Swiss president leaving the White House empty-handed, the introduction of 100% duties on chips and semiconductors, and threats of 250% tariffs on pharmaceutical products all indicate that Donald Trump is far from done.

The U.S. president is seriously determined to use import tariffs to bring manufacturers back to the United States and to replenish the federal budget. However, critics argue that the burden of tariffs will fall on the shoulders of Americans. The White House's protectionism may lead to shortages of goods and runaway inflation. The Federal Reserve will be left unsure whether to support the labor market or to raise interest rates to regain control over prices.

If an erratic central bank compounds trade and political uncertainty, the situation could spiral out of control. Until 2025, non-residents were flocking to U.S. assets like bees to honey. Now, they're fleeing at full speed. The capital outflow from North America to Europe is a strong argument in favor of buying EUR/USD.

There is the potential for de-escalation of the armed conflict in Ukraine. The presidents of the U.S. and Russia intend to meet to discuss peace efforts. If things go well, the euro and other currencies of the EU could become the main beneficiaries of a reduction in geopolitical tensions in Eastern Europe. Credit Agricole expressed this view, and I tend to agree.

However, no one knows how the negotiations between Washington and Moscow will end. The positions of the two sides are extremely far apart. A breakdown in talks between the U.S. and Russian presidents, followed by new sanctions and secondary import tariffs, would likely drive oil prices higher. This would increase the likelihood of accelerating inflation in the United States, forcing the Fed to return to a more cautious approach. In such a scenario, the main beneficiary would be the U.S. dollar.

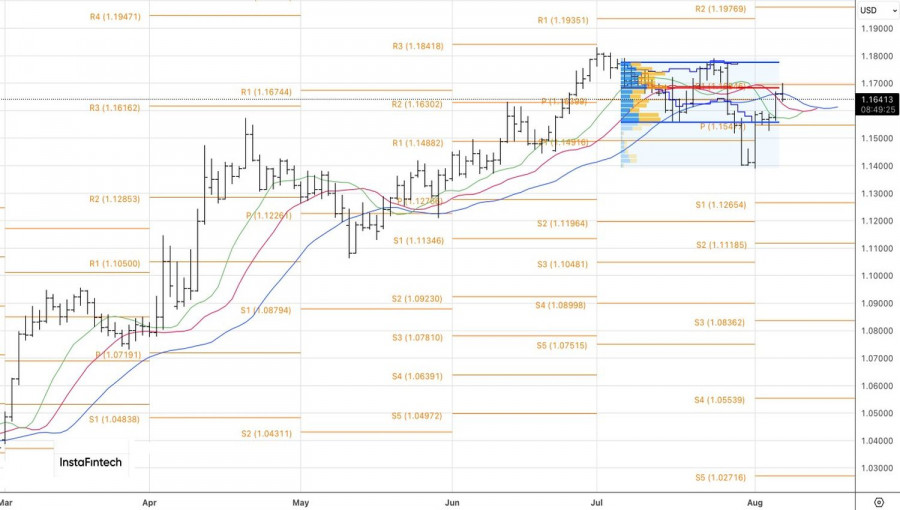

Technically, on the daily EUR/USD chart, there was a test of fair value at 1.170. The first attempt to break resistance was unsuccessful for the bulls. However, buyers are not giving up and are likely to try again. If successful, the risk of a resumed uptrend in the major currency pair will increase, and traders will have an opportunity to build on their long euro positions initiated from the 1.155 level against the U.S. dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.