See also

13.08.2025 05:00 AM

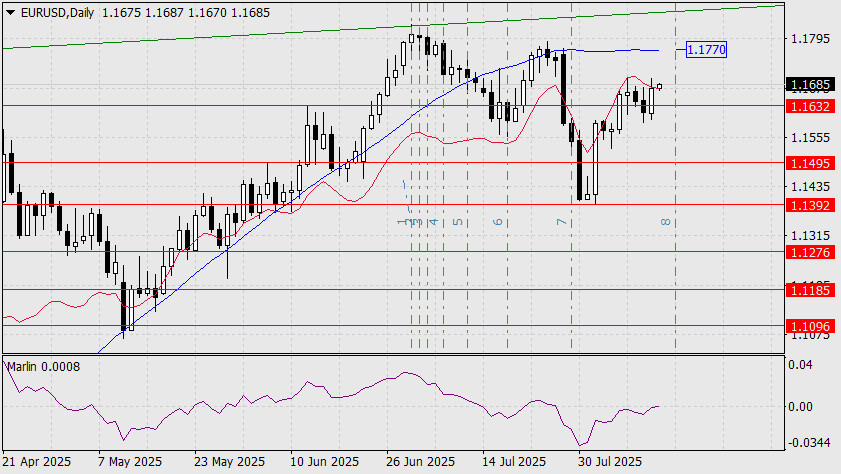

13.08.2025 05:00 AMYesterday, the euro once again attempted to test the balance line resistance. This time, it was supported by external markets — the S&P 500 rose by 1.14% and even set a new all-time high. However, the euro is in no hurry — it has not broken out of its range, as it is approaching Fibonacci time period No. 8 on the daily scale. Moreover, the stock market rally itself is facing increasing risks.

The Marlin oscillator's signal line is moving into positive territory. A slight rise is possible, as is a reversal from the upper boundary of the range. Today's session opened above the balance line, so there is a chance of surpassing yesterday's high. The maximum potential growth is toward the MACD line at 1.1770. At the moment, time remains the key factor.

The updated range is visible on the four-hour chart (grey rectangle). Here, the Marlin oscillator remains in negative territory, making it difficult for the price to replicate yesterday's surge. Overall, the sideways movement continues.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.