See also

14.08.2025 04:57 AM

14.08.2025 04:57 AMOnce again, the British pound has emerged as a leader in the currency market during the rise in stock indexes, showing strong risk appetite. However, we will see the consequences of this on Monday, when the meeting between the leaders of Russia and the United States in Alaska concludes.

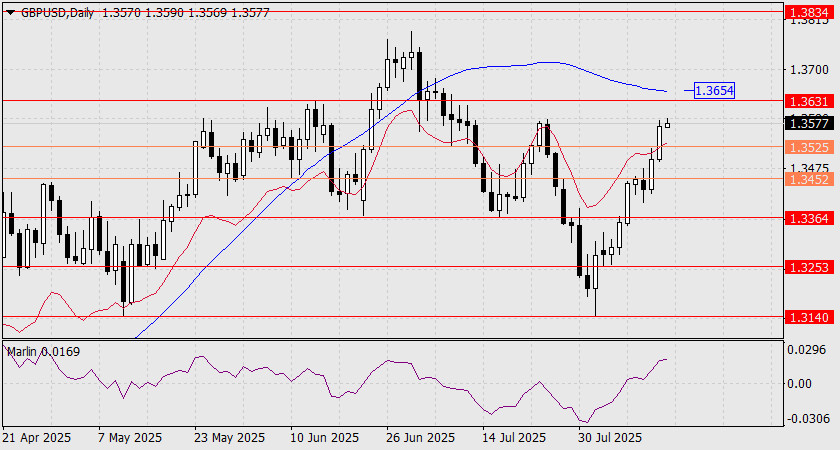

For now, the pound is aiming for the target range of 1.3631/54, defined by the June 13 high and the daily-scale MACD line. The Marlin oscillator is rising, though its rate of ascent is slightly slowing.

On the four-hour scale, the Marlin oscillator has been declining for quite some time — since August 8 — when signals emerged from the Federal Reserve about a possible double rate cut before the end of the year (Kashkari, Cook, Daly, Bostic).

Today, however, important economic data will be released in the UK. The forecasts are not encouraging: GDP growth for the second quarter is expected at just 0.1%, lowering annual growth from 1.3% to 1.0% y/y. Industrial production for June is expected to grow by 0.4%, but after a -0.9% drop in May, this increase appears insufficient.

In the US, the Producer Price Index (PPI) for July may come in at 2.5% y/y compared to 2.3% y/y in June. Until September — the date of the next Fed meeting — investors may still have reasons to worry.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.