See also

15.08.2025 12:47 PM

15.08.2025 12:47 PMAccording to data released today by Japan's Cabinet Office, the Japanese economy grew by 1% year-on-year in the April–June period. This figure significantly exceeded analysts' expectations of 0.4% growth and also marked a reversal from the 0.2% contraction recorded in the first quarter. These results reinforced the Bank of Japan's hawkish stance and kept open the possibility of a rate hike before the end of this year. Such a scenario is putting pressure on the AUD/JPY pair.

The Australian dollar's weak performance against the yen is also linked to the Reserve Bank of Australia's (RBA) dovish approach. Earlier this week, the RBA cut its interest rate for the third time in 2025 — returning it to the April 2023 level. The RBA statement noted that slowing inflation could lead to further rate cuts. RBA Governor Michele Bullock did not rule out the possibility of consecutive rate reductions. These factors are adding pressure on AUD/JPY, confirming the short-term bearish outlook.

Meanwhile, global risk sentiment remains positive, supported by the three-month extension of the U.S.–China trade truce and hopes that the upcoming U.S.–Russia summit will increase the chances of ending the prolonged conflict in Ukraine. These developments could reduce demand for the Japanese yen as a safe-haven asset and provide some support to the risk-sensitive Australian dollar. However, current price action reflects moderate weekly losses for AUD/JPY.

From a technical standpoint, daily chart oscillators are mixed, with the Relative Strength Index moving into negative territory, reinforcing the bearish forecast.

The pair has found support at 95.55. If prices decline and fall below the 200-day simple moving average (SMA), the drop could accelerate toward the key psychological level of 95.00. A break below this level would indicate that bears have gained control over bulls.

On the other hand, today's high above the 96.00 level, around 96.05, is the immediate barrier. A break above this mark would open the way for AUD/JPY to reach 96.31, near yesterday's swing high, followed by 96.80 and the 97.00 psychological level.

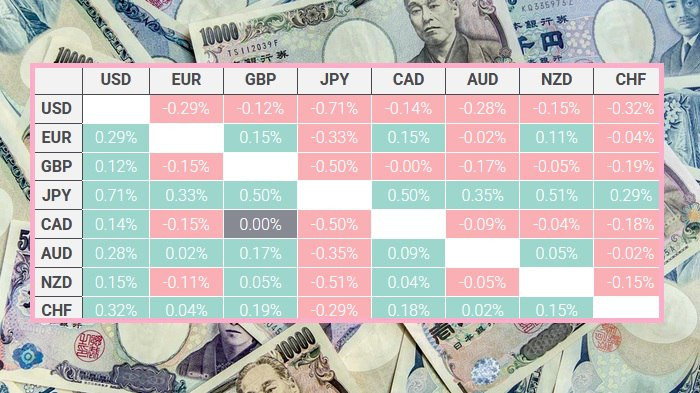

The table below shows today's percentage change in the Japanese yen's exchange rate against major currencies. The yen has shown its strongest gains against the U.S. dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.