See also

20.08.2025 04:52 AM

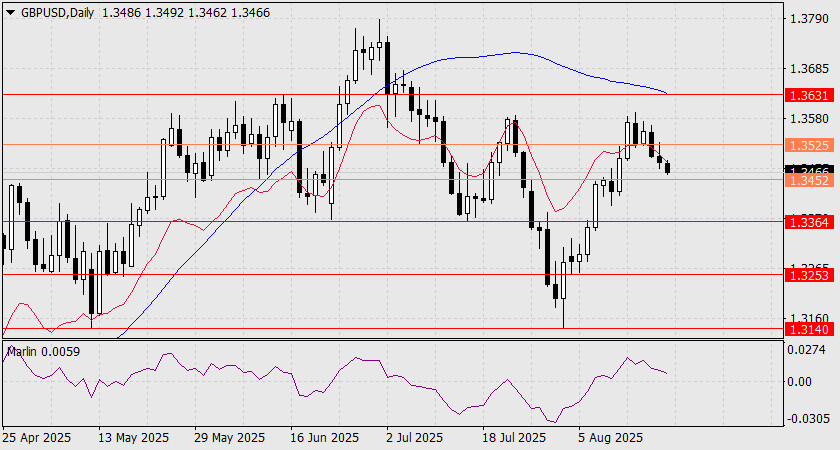

20.08.2025 04:52 AMYesterday, the British pound consolidated below the balance indicator line on the daily chart. This signals a shift in speculators' interest toward selling. The price will now attempt to break through the intermediate level of 1.3452 to extend the decline toward 1.3364.

Today, a large batch of UK inflation data for July will be released. Core CPI is expected to remain unchanged at 3.7% y/y, while headline CPI may rise slightly from 3.6% y/y to 3.7% y/y. Retail prices (RPI) could also increase to 4.5% y/y from 4.4% in June, and housing prices to 4.0% y/y from 3.9% previously. As we can see, forecasts suggest minimal changes, which means the data is likely to come out mixed. Since the pound approached this release in a pessimistic mood, we expect the downward movement to continue.

On the four-hour chart, the price consolidated below the MACD line. A consolidation below 1.3452 (even if it turns out to be false) will most likely occur. The Marlin oscillator entered negative territory on August 14 and has not yet moved deeply into this zone. This suggests it has ample room for a decline and has long been preparing for it.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.