See also

25.08.2025 04:57 AM

25.08.2025 04:57 AMIn his Friday speech, Federal Reserve Chair Jerome Powell stated: "price increases from tariffs may lead to more persistent inflation, and this factor requires constant monitoring," while also noting that "demand and supply for the labor force are declining," which overall "increases the risk of lower employment." In these key remarks, there was no indication of a December rate cut. As expected, the tone was: "We will cut in September and see the effect." Yet the U.S. dollar index fell by 0.93%. This suggests that the decline was more of a psychological reaction and, at the same time, a speculative move. Bitcoin, which trades nonstop, has already erased Friday's rally with a decline.

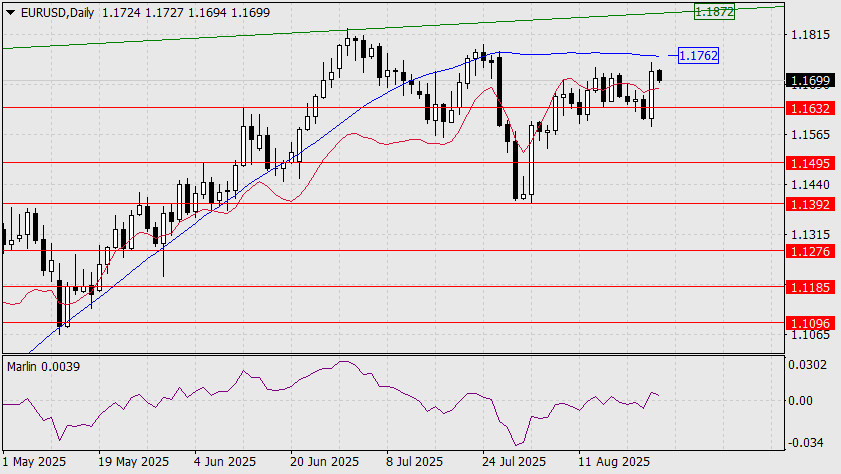

On the daily chart, the euro moved above the balance indicator line, but to confirm the breakout, it must consolidate above the MACD line (1.1762), which would then open the path to 1.1872. At present, however, the price may slip back under the balance line. A return below 1.1632 would fully neutralize Friday's rally and open the target at 1.1495. The Marlin oscillator has settled in positive territory, so any price reversal could stretch over two days.

The first sign of such a reversal would be a consolidation below the MACD line on the four-hour chart, under the 1.1686 mark. From there, we would expect further downward movement and a test of support at 1.1632.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.