See also

09.09.2025 07:58 AM

09.09.2025 07:58 AMThe US dollar continued to lose ground slowly but steadily against the euro, the pound, and other risk assets. Apparently, the pressure on the dollar is coming from expectations of the Federal Reserve's first interest rate cut this year, anticipated for the middle of this month.

Today, data on changes in France's industrial production will be released, and Bundesbank President Joachim Nagel is scheduled to speak. There will also be a Eurogroup meeting, which will likely not have a significant impact on the currency market.

Market participants will closely watch the French data. Any unexpected deviations from forecasted values could cause short-term volatility in the euro against other currencies. Joachim Nagel's speech is also of interest to traders. The Bundesbank president usually adheres to a conservative rhetoric; however, his comments regarding inflation and the future monetary policy of the European Central Bank could become key drivers for the euro movement.

The Eurogroup meeting, while important from a political standpoint, is unlikely to bring about immediate changes in the currency markets. The issues discussed are generally long-term and do not have an instant effect on exchange rates.

If the data matches economists' expectations, it's better to rely on a Mean Reversion strategy. If the data is much higher or lower than economists' expectations, it's best to use a Momentum strategy.

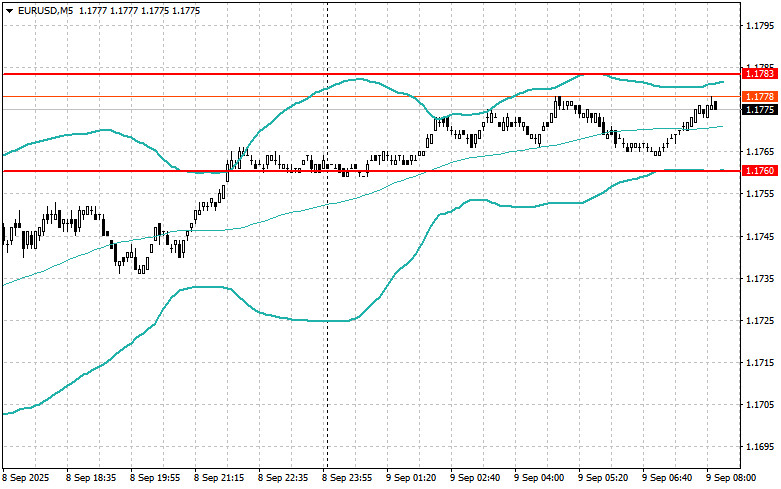

Buying on a breakout above the 1.1781 level could lead to euro gains toward 1.1825 and 1.1866.

Selling on a breakout below 1.1750 could lead to a euro decline toward 1.1715 and 1.1690.

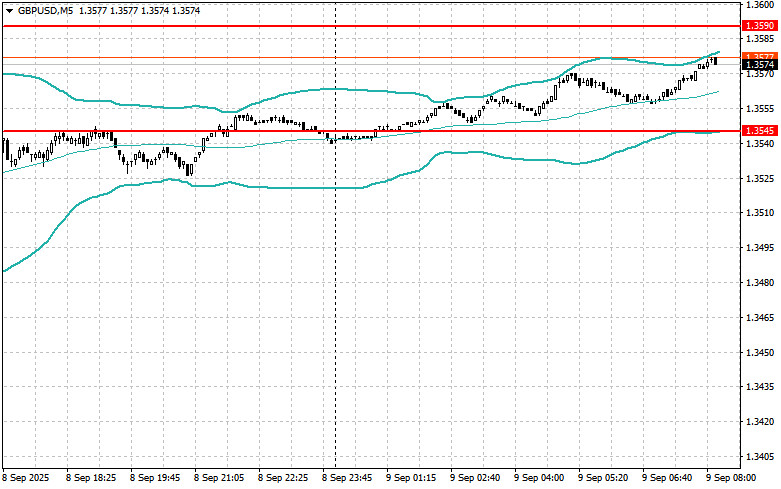

Buying on a breakout above 1.3587 could take the pound toward 1.3615 and 1.3643.

Selling on a breakout below 1.3553 could lead to a pound decline toward 1.3519 and 1.3484.

Buying on a breakout above 147.30 could take the dollar toward 147.84 and 148.13.

Selling on a breakout below 146.98 could lead to dollar weakening toward 146.66 and 146.30.

I will look for sells after a failed breakout above 1.1783 and a return below this level.

I will look for buys after a failed breakout below 1.1760 and a return above this level.

I will look for sells after a failed breakout above 1.3590 and a return below this level.

I will look for buys after a failed breakout below 1.3545 and a return above this level.

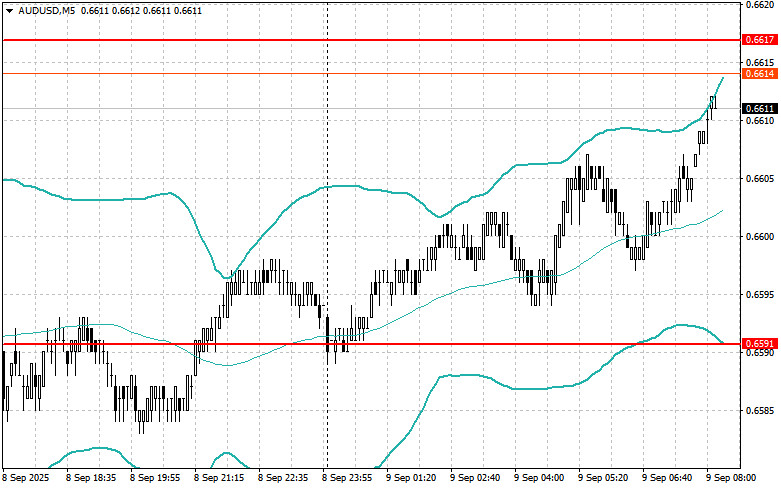

I will look for sells after a failed breakout above 0.6617 and a return below this level.

I will look for buys after a failed breakout below 0.6591 and a return above this level.

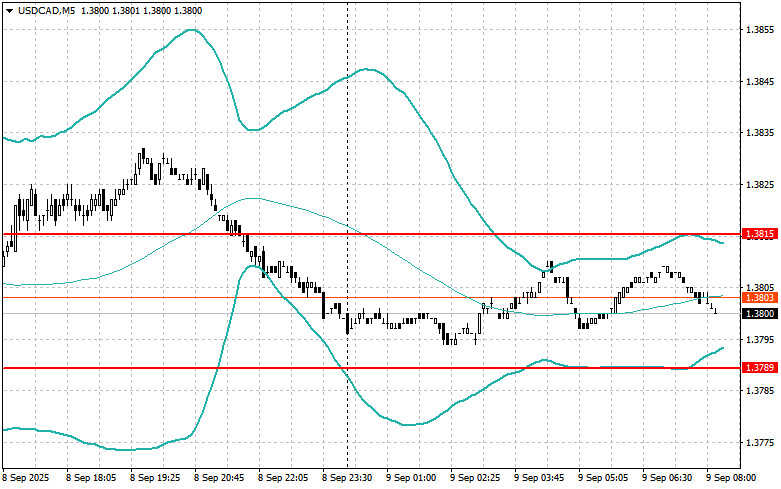

I will look for sells after a failed breakout above 1.3815 and a return below this level.

I will look for buys after a failed breakout below 1.3789 and a return above this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.