See also

10.09.2025 05:59 PM

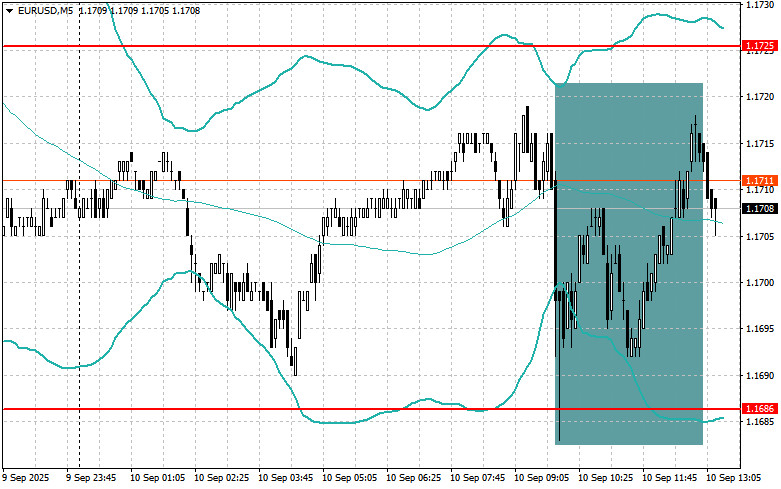

10.09.2025 05:59 PMOnly the euro was traded today using the Mean Reversion strategy. I did not trade anything with Momentum.

Italian industrial data provided some encouragement, allowing euro buyers to maintain a leading position. This positive impulse from Italy somewhat eased concerns about difficulties in the industrial sector. However, one should not forget that Italy's economic problems have not disappeared. Success in the manufacturing sector is a good sign, but it is not enough on its own to fundamentally change the situation.

In the second half of the day, data is expected on the U.S. Producer Price Index (PPI) for August, the core Producer Price Index excluding food and energy prices, as well as changes in wholesale inventories. These releases will be among the key indicators of inflationary pressure in the U.S. economy and will determine the further trajectory of the Federal Reserve's monetary policy.

Special attention will be paid to the core Producer Price Index, which excludes volatile components such as food and energy. Its dynamics will allow for a more accurate assessment of the persistence of inflationary processes and their impact on final consumer prices. The change in wholesale inventories, in turn, will provide information on the state of supply and demand across various markets.

In the case of strong statistics, I will rely on implementing the Momentum strategy. If the market shows no reaction to the data, I will continue to use the Mean Reversion strategy.

Momentum strategy (breakout) for the second half of the day:

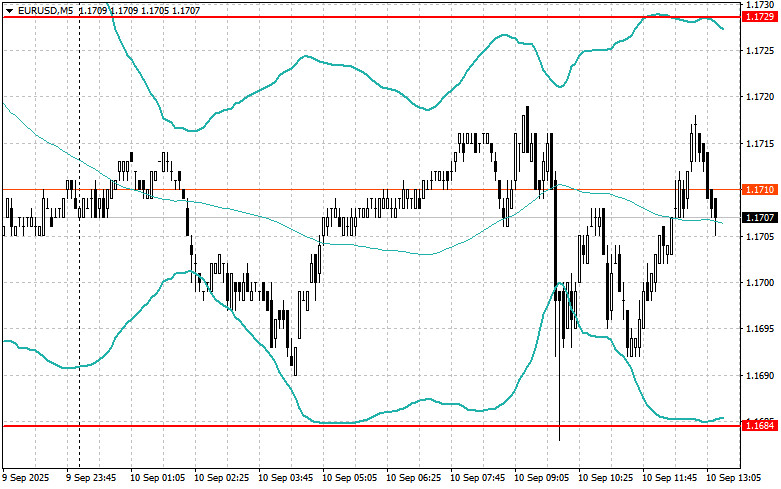

For EUR/USD

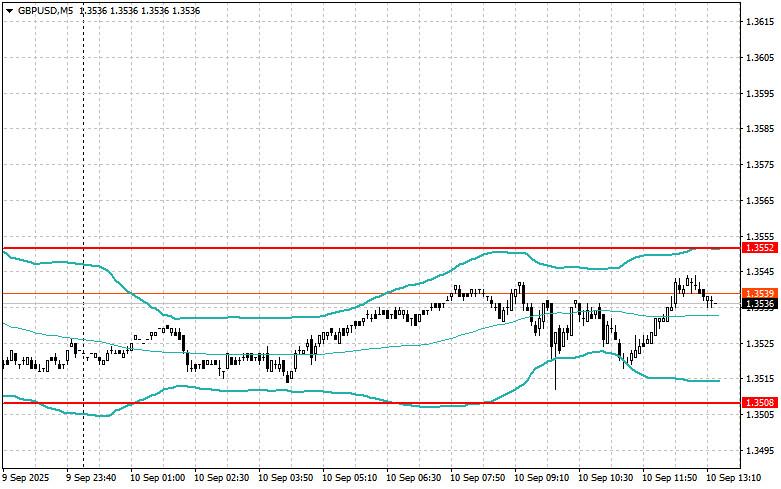

For GBP/USD

For USD/JPY

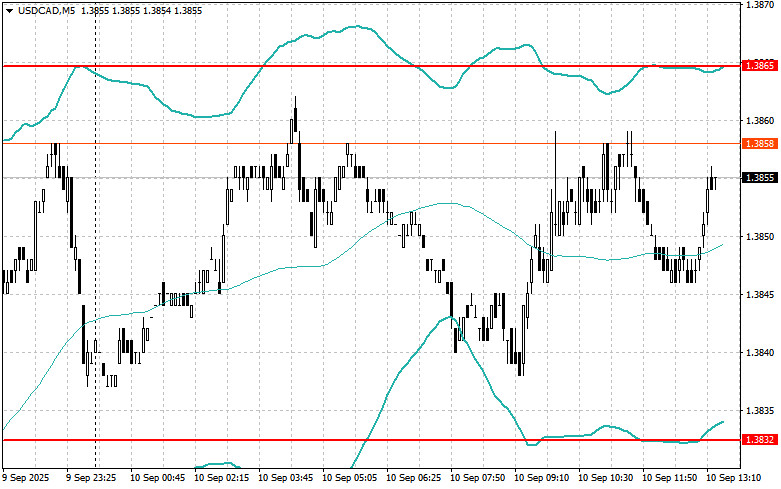

Mean Reversion strategy (reversal) for the second half of the day:

For EUR/USD

For GBP/USD

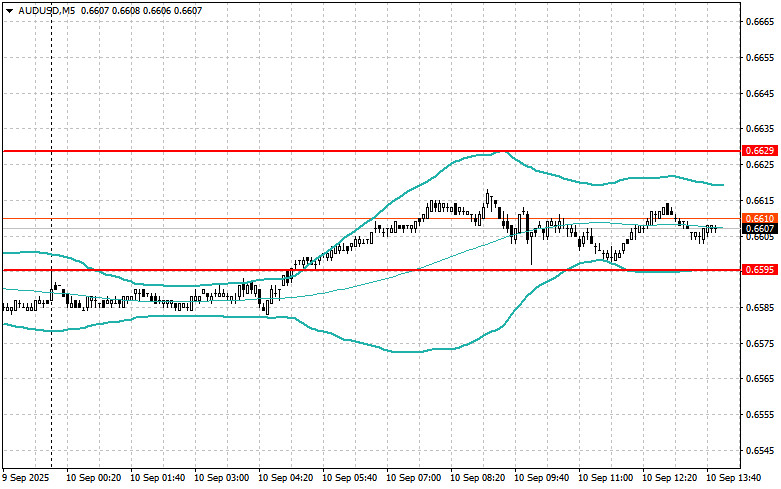

For AUD/USD

For USD/CAD

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.