See also

22.09.2025 11:21 AM

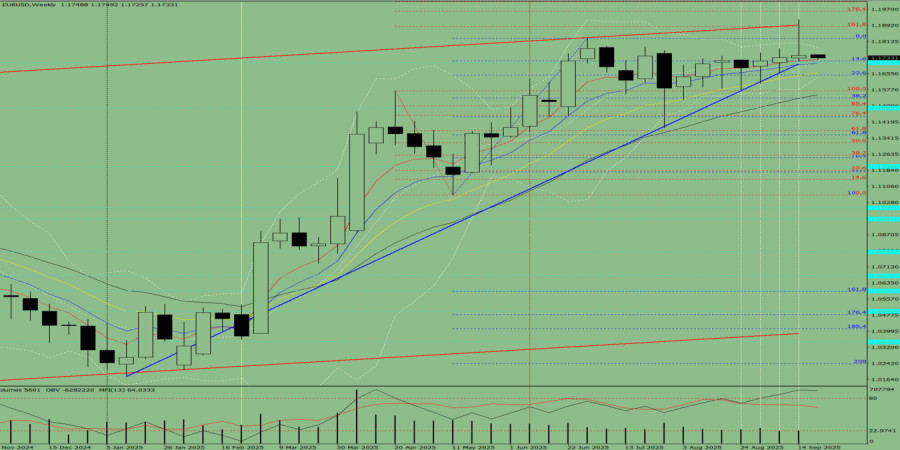

22.09.2025 11:21 AMTrend Analysis (Fig. 1)

This week, from the 1.1745 level (the close of the last weekly candle), the market may begin moving down with a target of 1.1536 – the 38.2% retracement level (blue dashed line). Upon testing this level, the price may bounce upward toward the target of 1.1572 – the upper fractal (red dashed line).

Fig. 1 (weekly chart)

Comprehensive Analysis:

Conclusion from comprehensive analysis: downward movement.

Overall candle projection for the EUR/USD pair on the weekly chart: the price is most likely to show a downward trend during the week, featuring an initial upper shadow on the weekly black (bearish) candle (Monday – upward move), and a secondary lower shadow (Friday – upward move).

Alternative Scenario: The pair may start moving downward from the 1.1745 level (close of the last weekly candle) with a target of 1.1572 – the upper fractal (red dashed line). Upon testing this level, the price may begin moving upward toward the 23.6% retracement level at 1.1647 (blue dashed line).

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.