See also

26.09.2025 04:57 AM

26.09.2025 04:57 AMGBP/USD

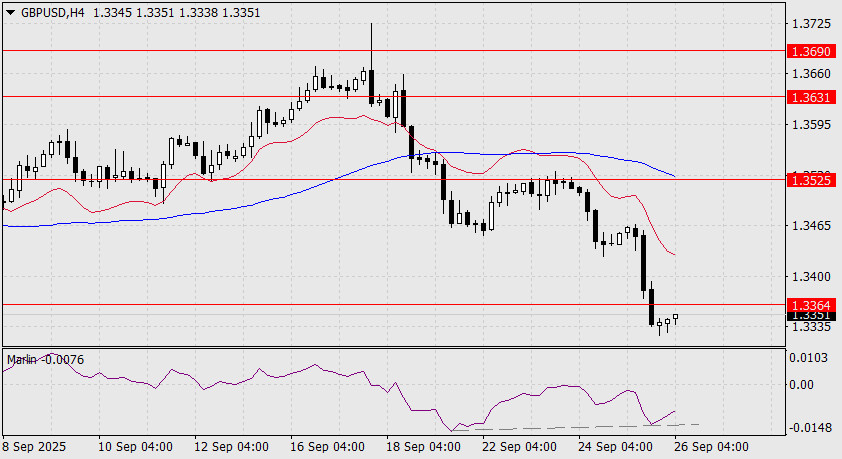

Against the backdrop of yesterday's 0.71% rise in the US dollar index, the British pound, which was already experiencing additional pressure from the policy divergence between the Bank of England and the Federal Reserve, lost 102 pips.

On the weekly chart, the price has broken below the MACD line. The Marlin oscillator has also consolidated in the territory of a downward trend. The pound is likely to face a prolonged decline ahead. The nearest significant target is the embedded price channel line around the 1.3000 mark.

On the daily chart, the price has broken below the nearest support at 1.3364. The next target at 1.3253 is now in play. The decline may continue to 1.3140—the lows from May and August. This is a strong level from which we expect a deep correction (approximately up to 1.3253). By then, the Marlin oscillator will reach the oversold zone and is also expected to correct.

On the four-hour chart, it may appear that the price and the Marlin oscillator have formed a convergence, but in reality, there is none—this is a manifestation of channel variations in this case. The price is consolidating below the 1.3364 level, and after this consolidation is complete, the main short-term (for now) downtrend will likely continue.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.