Triple Top

was formed on 04.06 at 04:00:18 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the NZDJPY M30 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -7, support level -11, and pattern’s width 27. Forecast If the price breaks through the support level 86.14, it is likely to move further down to 86.14.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

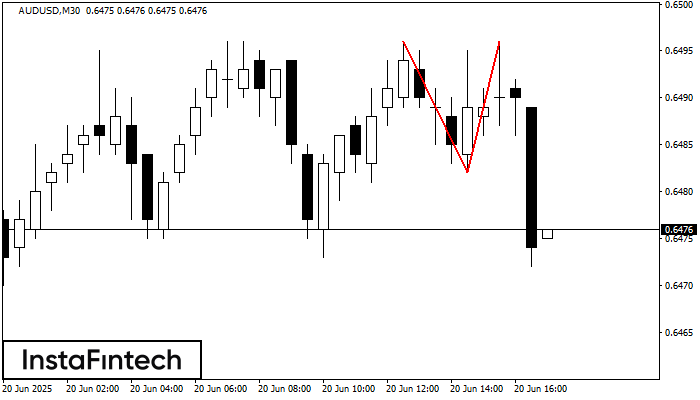

Double Top

was formed on 20.06 at 16:00:11 (UTC+0)

signal strength 3 of 5

On the chart of AUDUSD M30 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 0.6496; the lower boundary 0.6482; the width of the pattern 14 points

Open chart in a new window

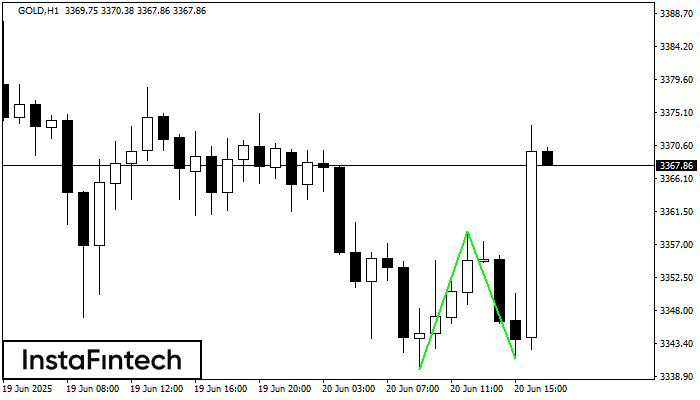

Double Bottom

was formed on 20.06 at 15:59:58 (UTC+0)

signal strength 4 of 5

The Double Bottom pattern has been formed on GOLD H1. Characteristics: the support level 3339.89; the resistance level 3358.78; the width of the pattern 1889 points. If the resistance level

Open chart in a new window

Inverse Head and Shoulder

was formed on 20.06 at 15:39:57 (UTC+0)

signal strength 1 of 5

According to M5, #MCD is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 289.77/289.97 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window