Lihat juga

18.07.2025 01:49 PM

18.07.2025 01:49 PMToday, the AUD/USD pair climbed above the key psychological level of 0.6500, attempting to confirm its recent positive momentum.

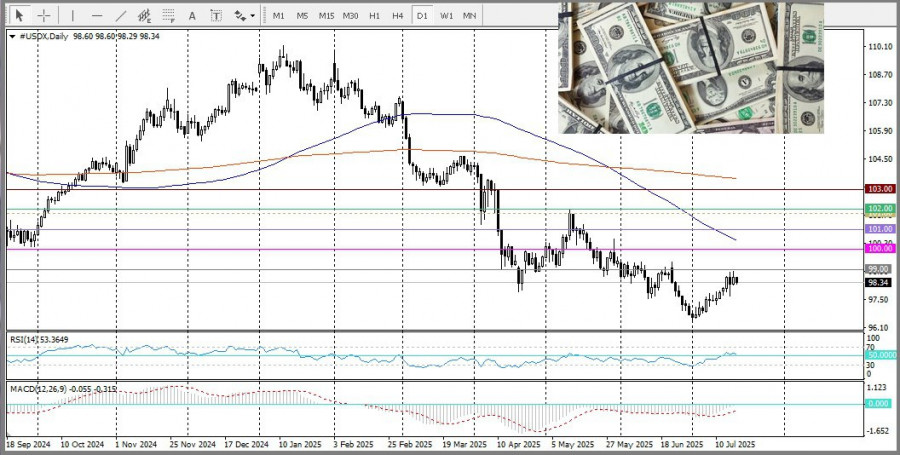

The main driver behind the Aussie's rise is the weakening of the US dollar, triggered by dovish comments from Federal Reserve Governor Christopher Waller, who spoke in favor of a rate cut in July due to growing risks to the economy.

These remarks, combined with a positive performance in global stock markets, are weighing on the US dollar — traditionally seen as a safe-haven currency — and creating favorable conditions for the risk-sensitive Australian dollar.

However, investors believe the Fed might postpone its rate cut until at least September, given signs that tariff hikes under the Trump administration are pushing up consumer prices. Support for this stance from key FOMC members, along with solid US macroeconomic data, limits the potential for a substantial US dollar decline and may hinder further upside in the AUD/USD pair.

On the other hand, Australia's employment data disappointed, highlighting ongoing labor market weakness. These figures reinforce expectations of a rate cut by the Reserve Bank of Australia, which may further constrain the pair's growth and call for caution among traders betting on a stronger Australian dollar.

To gain short-term momentum before the weekend, markets may focus on upcoming US macroeconomic releases. Overall, the current price action reflects a balance between monetary policy expectations and the internal economic outlooks of both countries.

From a technical standpoint, the pair is not yet ready for a sustained uptrend. This is confirmed by mixed signals from daily oscillators.

Additionally, on both hourly and 4-hour charts, prices remain below the 100-period Simple Moving Average (SMA), reinforcing the view that the Australian dollar remains weak relative to the US dollar.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.