यह भी देखें

15.08.2025 02:54 PM

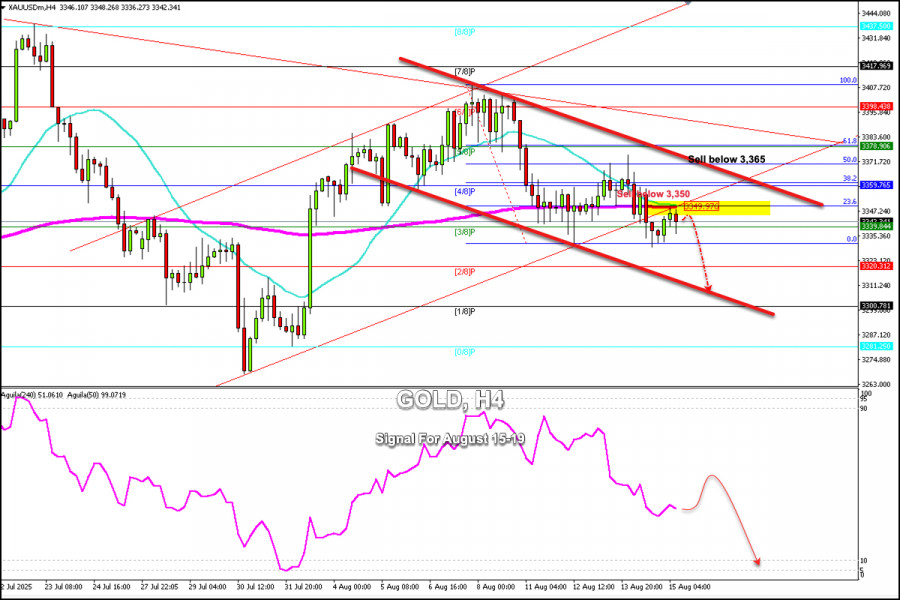

15.08.2025 02:54 PMGold, having reached 61.8%, is resuming its bearish cycle and is now consolidating below the 21SMA and the 200EMA, which could further indicate the possibility of a continuation of the bearish movement.

If gold consolidates below the 200EMA at 3,350 in the coming hours, any technical rebound will be seen as a signal to sell, with targets at 2/8 of the Murray at 3,320, and could even reach 0/8 of the Murray around 3,281.

If a technical rebound occurs, gold could reach the top of the downtrend channel around 3,365. This level could be seen as strong resistance, and below this area we could sell.

A consolidation above the 61.8% Fibonacci level at 3,378 could signal a resumption of the bullish cycle, and we could expect a rally reaching the 8/8 Murray level at 3,437.

Gold is trading below the 50% Fibonacci level or below 3,365 and within the bearish trend channel. Any technical rebound will be seen as an opportunity to sell, with targets at the psychological level of $3,300.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |