यह भी देखें

26.06.2025 05:11 AM

26.06.2025 05:11 AMEUR/USD

Yesterday's data on new home sales in the U.S. for May turned out worse than expected — 623,000 units were sold versus a forecast of 694,000, and the April figure was revised downward from 743,000 to 722,000. As a result, sales dropped by 13.7%. The euro rose by 49 points, while the S&P 500 closed the day unchanged.

Today is an important day for U.S. data. Q1 GDP may show a decline of -0.2%. The Personal Consumption Expenditures (PCE) Price Index for the same period is expected to rise from 2.4% to 3.6%, and durable goods orders for May are expected to increase by 8.6%. However, after April's drop of -6.3%, the new figure is not particularly impressive.

Technically, the U.S. dollar should come under pressure, but the stock market may experience equal pressure. The key issue lies in how synchronized the risk-off moves will be across the currency and equity markets.

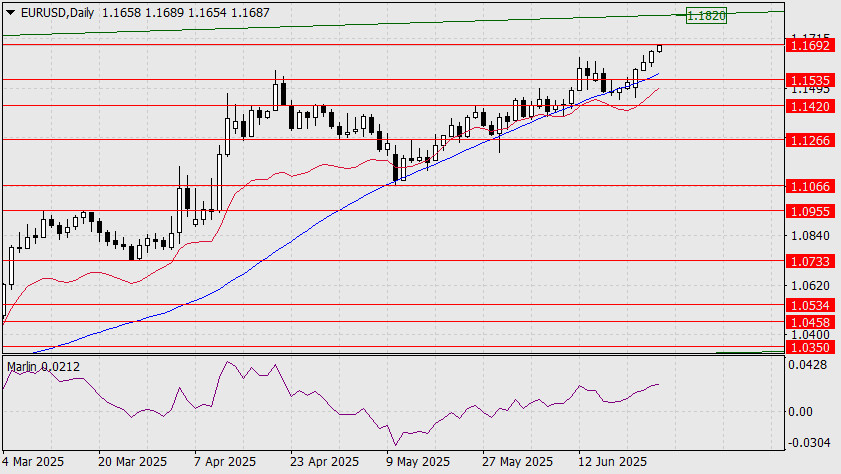

Looking again at the weekly euro chart, the divergence remains in place. It is hard to say whether it will still be valid if the price rises to the next target of 1.1826, but if it does happen, that would mark an ideal time for the euro to reverse into a medium-term downtrend.

On the daily chart, the target of 1.1820 corresponds to the upper boundary of the price channel. However, it's important to note that when trends reverse, the euro often fails to reach the edges of price channels.

The 4-hour chart does not add further clarity. The uptrend may continue if the price consolidates above the 1.1692 level amid favorable data.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |