यह भी देखें

15.07.2025 12:18 PM

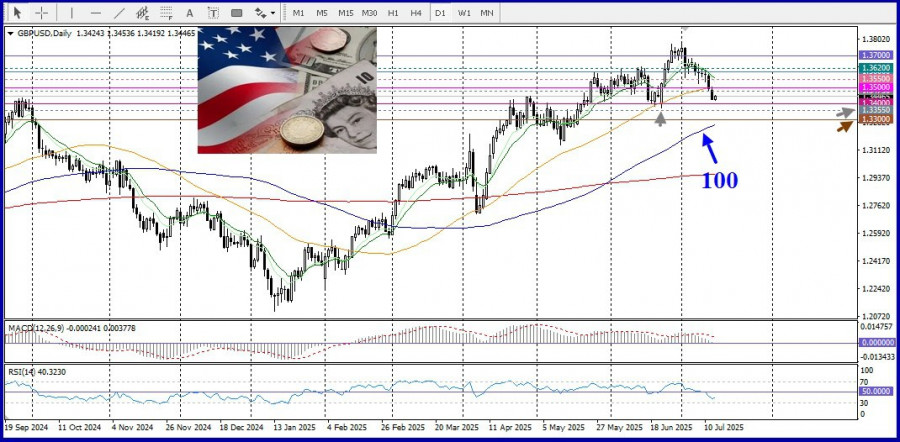

15.07.2025 12:18 PMThe GBP/USD pair is consolidating today within the 1.3430–1.3435 level, remaining slightly above the three-week low registered during the Asian trading session amid expectations of U.S. consumer inflation data. At the same time, fundamental factors favor a bearish scenario, suggesting that the next likely price move is downward.

Disappointing UK economic data released last week have reinforced expectations of another interest rate cut by the Bank of England in August. This stands in sharp contrast to the declining odds of an immediate rate cut by the Federal Reserve, which supports a negative outlook for the GBP/USD pair. Nevertheless, the pause in the U.S. dollar's rally is offering some support to the pair.

From a technical standpoint, the break below the 100-period Simple Moving Average (SMA) on the 4-hour chart, which occurred last week, was a key bearish signal. However, the Relative Strength Index (RSI) on the same timeframe is already showing oversold conditions, justifying the likelihood of intraday consolidation or a minor rebound before the GBP/USD pair resumes its short-term decline.

That said, any recovery attempts are likely to face resistance near the 1.3475 level, which will keep prices capped below the psychological barrier of 1.3500. A sustained move above that level could trigger short covering, pushing GBP/USD toward the intermediate resistance at 1.3550, and then to the next round level of 1.3600 and the supply zone at 1.3620–1.3625.

On the other hand, bears will be watching for a clear break below the key psychological support at 1.3400 before opening new short positions.

In that case, the GBP/USD pair could accelerate its decline toward the next significant support around 1.3355, followed by a move toward the 1.3300 round level. Further losses may lead to a test of the 100-day Simple Moving Average (SMA), currently located near the 1.3265 level.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |