यह भी देखें

26.09.2025 06:58 AM

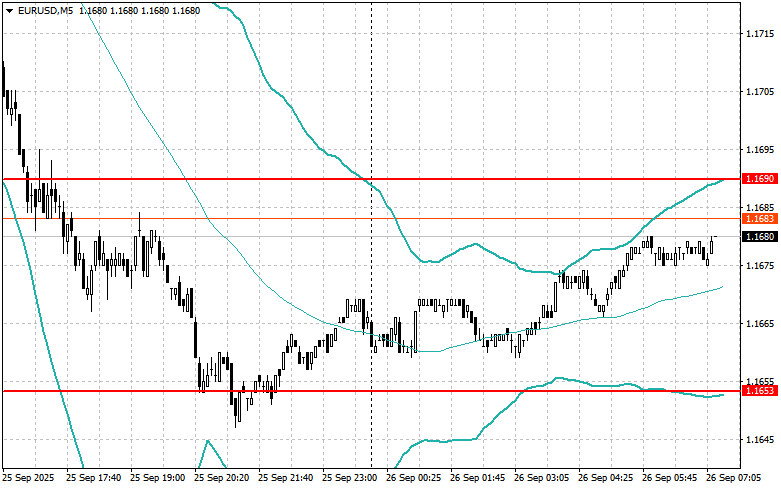

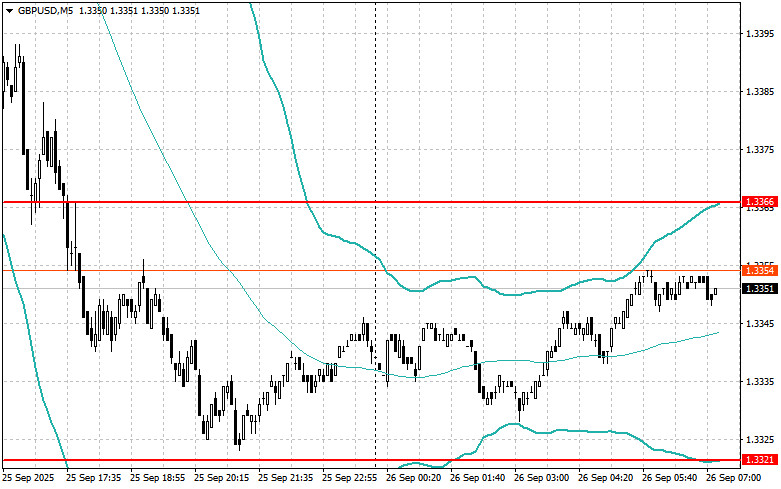

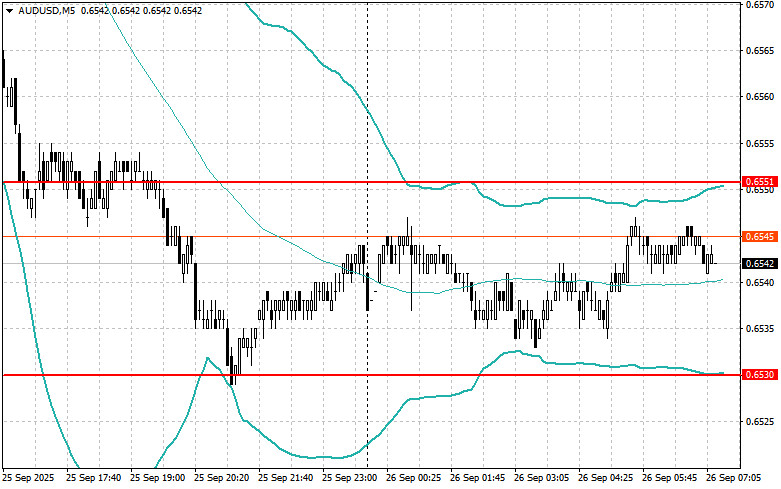

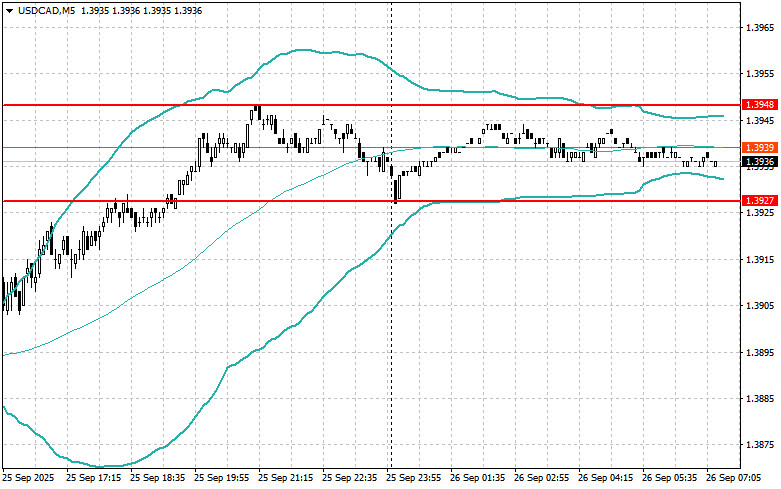

26.09.2025 06:58 AMThe US dollar continued its growth against a range of risk assets, indicating sustained demand and the prospect of more cautious action from the Federal Reserve regarding interest rate cuts.

Yesterday's upward revision of Q2 US GDP to a strong 3.8% was the trigger for dollar buying and a selloff in risk assets. Clearly, after contracting in Q1, the US economy is showing unexpected resilience despite the Fed's tight monetary policy. This, in turn, strengthens investors' confidence in the US economy's ability to withstand future challenges. Yesterday's sharp drop in jobless claims also points to a labor market that is once again showing strength, despite some signs of cooling.

Today promises to be an eventful day on European financial markets, marked by numerous macroeconomic announcements; however, prospects for optimists hoping for euro strength appear rather cloudy. In the first half of the day, attention will be focused on Spanish GDP data. While any positive surprises from Madrid will certainly be well-received by the market, they are unlikely to change the overall picture. The more significant event will undoubtedly be the speech by European Central Bank President Christine Lagarde. Traders will analyze each of her words carefully, searching for hints regarding the central bank's future monetary policy. Lagarde is most likely to use cautious and balanced language, avoiding sharp statements that could destabilize markets.

If the data aligns with economists' expectations, it is advisable to employ a Mean Reversion strategy. If the data turns out to be significantly above or below economists' forecasts, a Momentum strategy is recommended.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |