Lihat juga

23.06.2025 05:56 PM

23.06.2025 05:56 PMHari ini, Isnin, tekanan jualan ke atas yen Jepun menguasai pasaran, dipacu oleh beberapa faktor utama. Para pedagang terus menangguhkan jangkaan terhadap kemungkinan kenaikan kadar faedah oleh Bank of Japan, dengan andaian bahawa langkah seterusnya mungkin tidak berlaku sebelum suku pertama tahun 2026. Di samping itu, kebimbangan terhadap kesan ekonomi negatif akibat tarif sedia ada dari Amerika Syarikat—25% ke atas kereta Jepun dan 24% ke atas import lain—menekan mata wang Timur Jauh tersebut, sekali gus mengurangkan tarikannya.

Akibatnya, pasangan USD/JPY mencapai paras tertinggi baharu sejak 14 Mei dan menghampiri paras psikologi 148.00. Ini berlaku di tengah-tengah pengukuhan sederhana dolar AS dan tekanan berterusan daripada pembeli dolar.

Meskipun data Indeks Harga Pengguna (CPI) tahunan Jepun yang diterbitkan pada hari Jumaat melepasi sasaran 2% Bank of Japan secara ketara, serta angka PMI yang lebih tinggi daripada jangkaan—faktor yang seharusnya mendorong bank pusat ke arah kenaikan kadar selanjutnya dalam beberapa bulan akan datang—namun pembeli yen masih belum menerima sokongan.

Faktor-faktor ini menunjukkan bahawa laluan paling mudah bagi USD/JPY kekal dalam arah menaik.

Dari sudut dolar AS, Rizab Persekutuan meramalkan dua pemotongan kadar faedah tahun ini; namun begitu, pegawai hanya menjangkakan satu pemotongan sebanyak 25 mata asas masing-masing pada tahun 2026 dan 2027. Pendirian ini berpunca daripada kebimbangan bahawa langkah tarif yang diperkenalkan oleh pentadbiran Donald Trump boleh menyebabkan kenaikan harga pengguna, sekali gus menyokong dolar AS dan mewujudkan keadaan yang menggalakkan untuk kesinambungan kekuatannya dalam pasaran pertukaran asing.

Dari sudut teknikal, harga telah menembusi Purata Bergerak 100 hari (SMA) dan paras psikologi 147.00. Penunjuk pengayun pada carta harian kekal dalam zon positif, mengesahkan prospek kenaikan untuk pasangan ini.

Rintangan telah dikesan pada paras bulat 148.00. Jika paras ini berjaya ditembusi, rintangan seterusnya ialah paras tertinggi bulan Mei.

Paras sokongan dijangka berada pada paras psikologi 147.00 dan SMA 100 hari sekitar 146.80, diikuti oleh julat biasa yang telah diperhatikan sepanjang tiga minggu lalu.

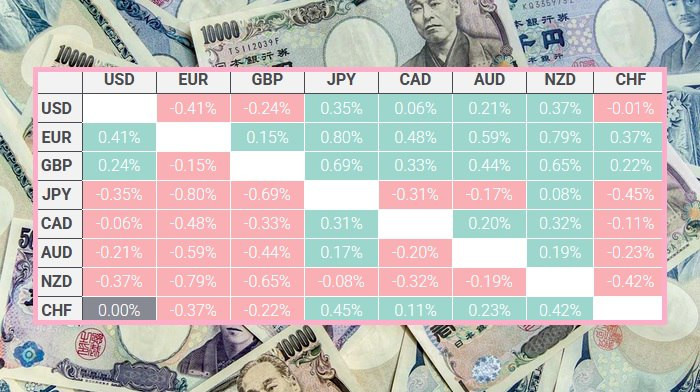

Jadual di bawah menunjukkan peratusan perubahan yen Jepun hari ini berbanding mata wang utama yang tersenarai.

Yen Jepun menunjukkan kekuatan paling tinggi terhadap dolar New Zealand.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.