یہ بھی دیکھیں

14.05.2025 05:03 AM

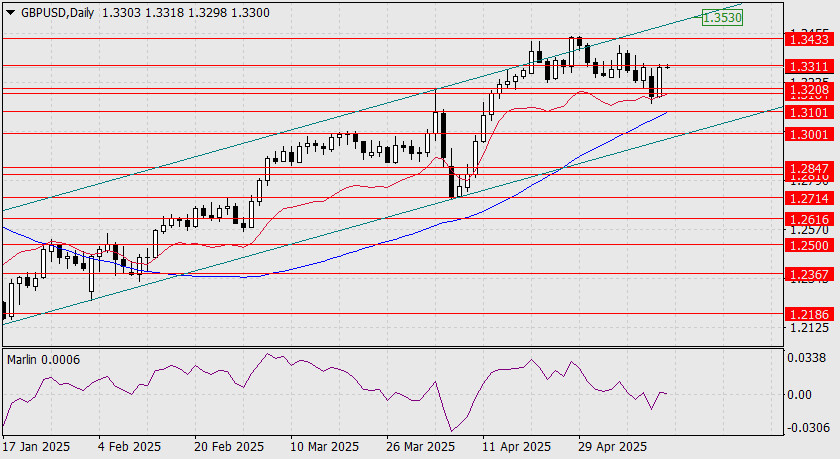

14.05.2025 05:03 AMAmid yesterday's surge in risk appetite and general market optimism (S&P 500 +0.72%, WTI +2.78%, Dollar Index -0.76%), the British pound did not attempt to test the target support at 1.3101. Instead, it moved upward and reached the target resistance level at 1.3311.

This morning, the price continues to press against the reached resistance level, supported by the Marlin oscillator moving into positive territory. A confident breakout above this level would allow further growth toward the target at 1.3433. Beyond that, a continued advance toward the upper boundary of the price channel near the 1.3530 mark is likely.

On the four-hour chart, the price has settled above the MACD indicator line, which increases the likelihood of consolidation above the 1.3311 resistance level. Once this happens, the path toward 1.3433 opens up. This is the primary scenario. The Marlin oscillator has confirmed its position in bullish territory.

An alternative scenario may unfold if the price falls below the support level from May 1–6 at 1.3257 (highlighted by the gray rectangle). This level also approximately marks the midpoint between the 1.3208 and 1.3311 levels.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.