یہ بھی دیکھیں

18.06.2025 04:58 AM

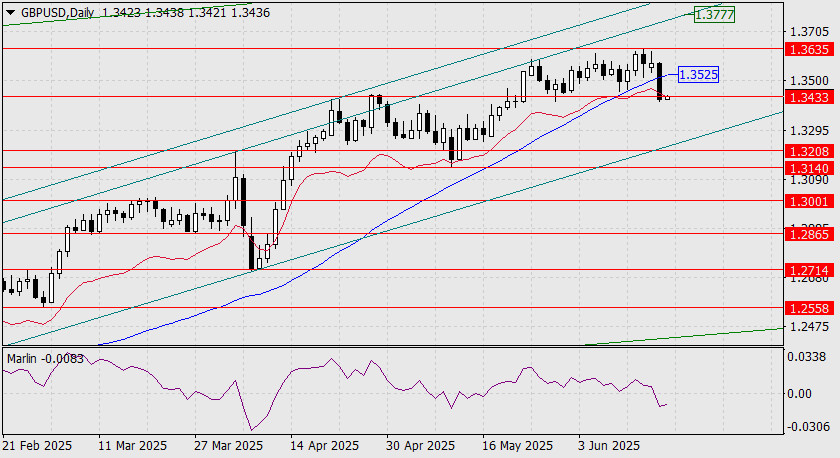

18.06.2025 04:58 AMThe British pound failed to withstand the dollar's pressure yesterday amid global risk aversion and plummeted by 148 pips. The decline stopped at strong support at 1.3433 — the high of September 2024, the high of April this year, and the support from May 29.

If today's Federal Reserve meeting turns out to be dovish (the baseline scenario), the pound may recover above the MACD line on the daily chart (1.3525) and later overcome resistance at 1.3635. That would open the path toward 1.3777, which aligns with the ascending price channel line. The recent drop of the Marlin oscillator below the zero line would then be interpreted as a false signal.

If the price consolidates below 1.3433, it may enter the target range of 1.3140–1.3208. This represents the alternative scenario.

A sign of a reversal — or more precisely, a stall in price movement — on the four-hour chart is the accelerated drop of the Marlin oscillator, which is already approaching the oversold zone. Should the price continue to decline sharply following the Fed meeting, a sharp rally could occur on Thursday or Friday — something that often happens in response to a rate change or a convincingly dovish tone.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.