یہ بھی دیکھیں

09.07.2025 06:30 AM

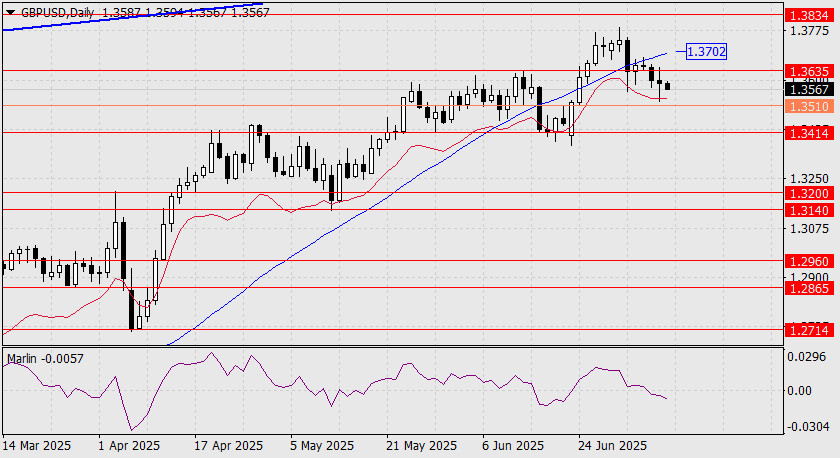

09.07.2025 06:30 AMYesterday, the British pound tested the area around the daily balance line. This move revealed the weakness of support levels on the path toward the target level of 1.3414, which is confirmed by the Marlin oscillator, steadily declining in negative territory. Nevertheless, the price did not push ahead to test the intermediate level of 1.3510, likely due to the upcoming GDP and industrial production data scheduled for release on Friday. It is likely that the next two days will see sideways movement between the 1.3510 and 1.3635 levels.

If risk appetite suddenly increases (for example, due to President Trump extending the tariff freeze from July 9 to August 1), a breakout above 1.3635 would not automatically signal the beginning of a rally, as the MACD line lies higher, around 1.3702. Any upward movement faces challenges.On the H4 chart, the Marlin oscillator is attempting to move into positive territory. The recent long lower shadow also points to the possibility of the price preparing for a downward breakout. However, on the upside, the price is already facing three resistance levels: the 1.3635 level and two MACD lines—on the H4 and daily charts—at 1.3702. The current setup suggests an increased likelihood of sideways movement.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.