Veja também

14.07.2025 07:21 AM

14.07.2025 07:21 AMUSD/CAD, July 14, 2025

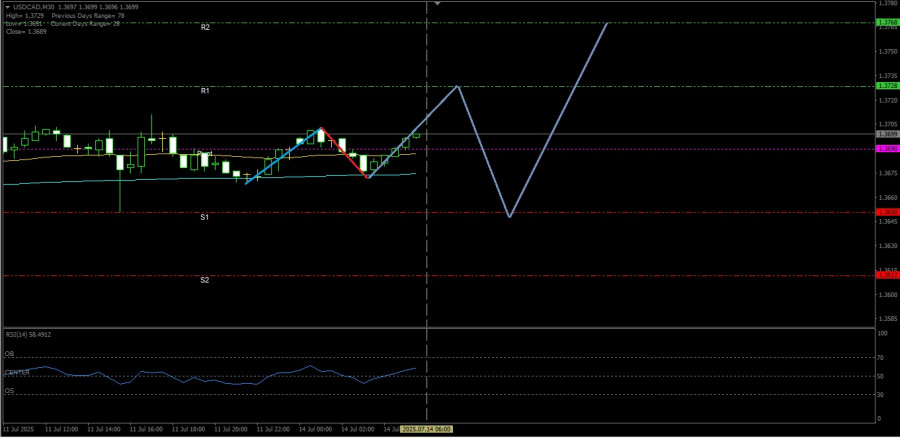

Although the Lonnie is moving in a neutral-bullish position, there is potential for the USD/CAD commodity currency pair to test its pivot and support levels today.

Key Levels

1. Resistance 2: 1.3768.

2. Resistance 1: 1.3728.

3. Pivot: 1.3690.

4. Support 1: 1.3650.

5. Support 2: 1.3612.

Tactical Scenario

Positive Reaction Zone: As long as the 1.3650 level can withstand the potential downward correction, acting as strong support, USD/CAD has the potential to strengthen again, rising to 1.3728.

Momentum Extension Bias: If 1.3728 is successfully broken and closes above it, USD/CAD has the opportunity to continue strengthening to 1.3768.

Invalidation Level / Bias Revision

Upside bias weakens when the price weakens and breaks through and closes below 1.3612.

Technical Summary

Although the Lonnie's price is moving sideways and ranging, the 50-day moving average (EMA) is at 1.3687 and the 200-day moving average (EMA) is at 1.3674, indicating a Golden Cross. Although the distance between the two is not significant, the RRSI (14) is at 58.49, indicating strengthening amid moderate volatility.

Economic News Release Agenda:

The threat of a 35% US tariff on Canada, as well as the still-good US employment data, coupled with continued weakness in oil prices, and global sentiment seeking safe-haven assets like the USD, are a combination that strongly supports the USD's strengthening against the Lonnie today.

CAD Wholesale Sales m/m - 7:30 PM WIB.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.