Veja também

16.06.2025 01:29 AM

16.06.2025 01:29 AMCharity begins at home. As it turns out, the 47th President of the United States' loyalty to the crypto industry is rooted in personal interests. Donald Trump and his family earned $57.7 million from the issuance of tokens by a digital asset company, which his sons helped launch in 2024. Although the White House denies any conflict of interest, investors are not so easily deceived. Bitcoin may serve as a barometer of Trump's effectiveness as head of state.

Bitcoin has taken on many identities. The market is still trying to define the role of the leading cryptocurrency. It is often associated with risk assets, although its trajectory sometimes diverges from U.S. stock indices. Conversely, it sometimes moves in sync with gold, which justifies its classification as a safe-haven asset. However, recent events in the Middle East cast doubt on that role.

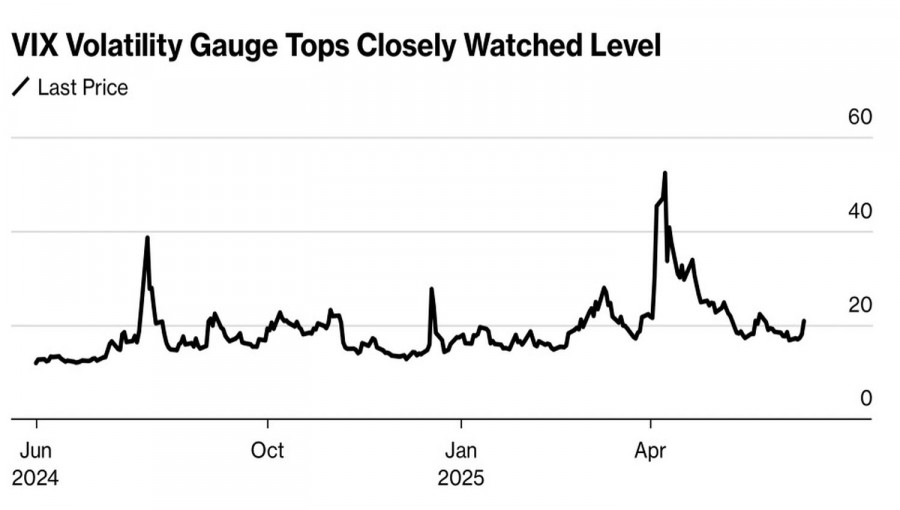

Israel's attacks on Iran, followed by retaliatory strikes, caused not only the S&P 500 to plunge but also sent digital assets tumbling. Altcoins like Solana and Cardano were among the hardest hit, declining for several days. Bitcoin, which accounts for about 60% of total crypto market capitalization, stabilized after an initial sell-off. Rising geopolitical risks replaced greed with fear, as reflected in the spike of the VIX volatility index.

Bitcoin has proven that it remains, first and foremost, a risk asset—even if it responds positively to the actions of crypto-friendly Trump.

Members of Trump's team continue to promote stablecoin legislation. For example, Scott Bessent claims that the global spread of Treasury-backed stablecoins will increase demand for U.S. dollars. The Treasury Secretary estimates that once Congress approves the new legislation, the volume of circulating stablecoins could rise from the current $250 billion to $2 trillion within the next few years. Citigroup offers a more modest estimate: $1 trillion by 2030.

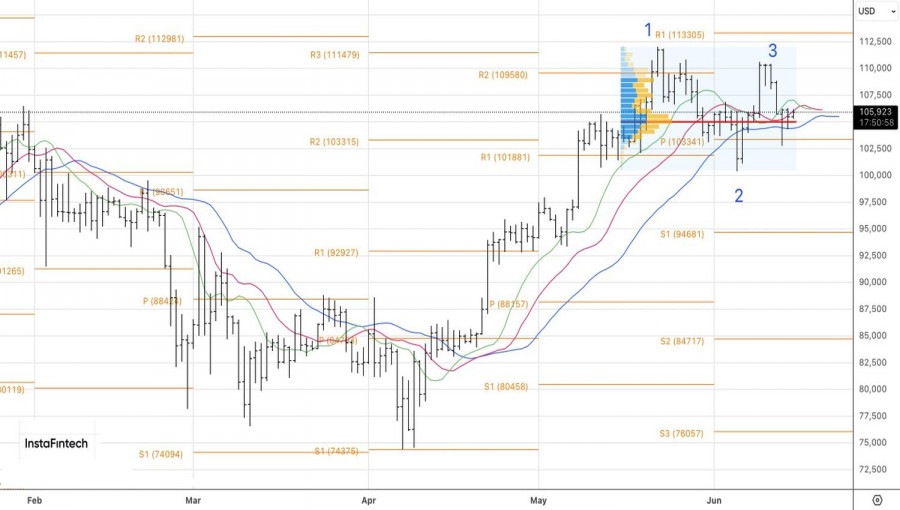

Thus, Trump's crypto sector support—rooted in personal interest—isn't going anywhere. This underpins the ongoing bullish trend in BTC/USD. The current pullback is driven by heightened geopolitical tensions in the Middle East and a related deterioration in global risk appetite. How deep the correction runs will depend on developments between Israel and Iran.

Strategy firm head Michael Saylor agrees with this interpretation. He believes the crypto winter won't return. Bitcoin is headed toward $1,000,000 and has no intention of collapsing to zero.

Technically, a 1-2-3 reversal pattern may be forming on the BTC/USD daily chart. For this pattern to activate, bears need to break through key support at the fair value of 105,000 and the pivot level at 103,300. Success at these levels would allow traders to consider forming short-term short positions.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.